The Super Mario Bros. film’s recent success at the global box office should be enough to convince larger publishers of gaming’s strategic potential.

The film recorded the biggest global opening weekend for an animated film, raking in $567 million over a five-day window. While the film has drawn a number of poor reviews, its financial success likely lies in its broad demographic reach — appealing to Gen X, Millennials, Gen Z and Gen Alpha alike.

Nostalgia, demand for new IP and the appeal of family friendly fodder make for a powerful combo.

While there are many reasons why the troubled 1993 Super Mario Bros. adaptation failed at the box office, one of the issues the directors cited was the fact that its target audience at the time was the children playing those games. Rocky Morton, one half of the directorial duo, argued that those kids were now grown ups, had “a voice in the cultural zeitgeist” and were eager to see such a movie in 2023.

The cultural zeitgeist that he refers to is one in which the gaming industry has come to dwarf the film, television and music industries combined. Gaming revenue is projected to hit $372 billion this year, with mobile gaming the principal driver of that growth.

And yet, despite this incredible potential, publishers seem to have largely missed the segment’s potential.

Games and Subscription Bundles

One notable exception is The New York Times. The NYT has made no bones of the fact that it wants to up-sell its subscribers on bundled subscriptions, thereby increasing their value.

The NYT’s acquisition of Wordle in 2022 has brought “tens of millions” of new users to the publisher, NYT head of games Jonathan Knight said last month. Around 1 million NYT subscribers are paying for access to its games as part of a wider bundle.

Gaming is now an integral part of the NYT’s top of the funnel (ToFu) marketing activities, with leads eventually being converted into high-value subscribers.

Knight said: “More and more we’re taking on new subscribers who previously would’ve added a game subscription and we’re offering them the ‘All Access’ bundle, which we think is a better deal and gives them access to more products to engage with.”

The NYT’s subscription efforts are yielding results, with one study showing that the publisher is in the global top 10 when it comes to converting its audience into subscribers. More than 6% of its website visitors are subscribers.

The success of its diverse gaming offerings (with Sudoku being the most recent addition) over the last four years has seen the publisher move to rebrand its New York Times Crossword section to New York Times Games.

It’s not just the NYT, however, that’s experimenting with games to drive engagement.

A Game by Any Other Name

Norwegian business daily Dagens Næringsliv, Swedish financial newspaper Dagens industri (DI) and UK daily The Telegraph have all been looking for ways to use games to reach new audiences.

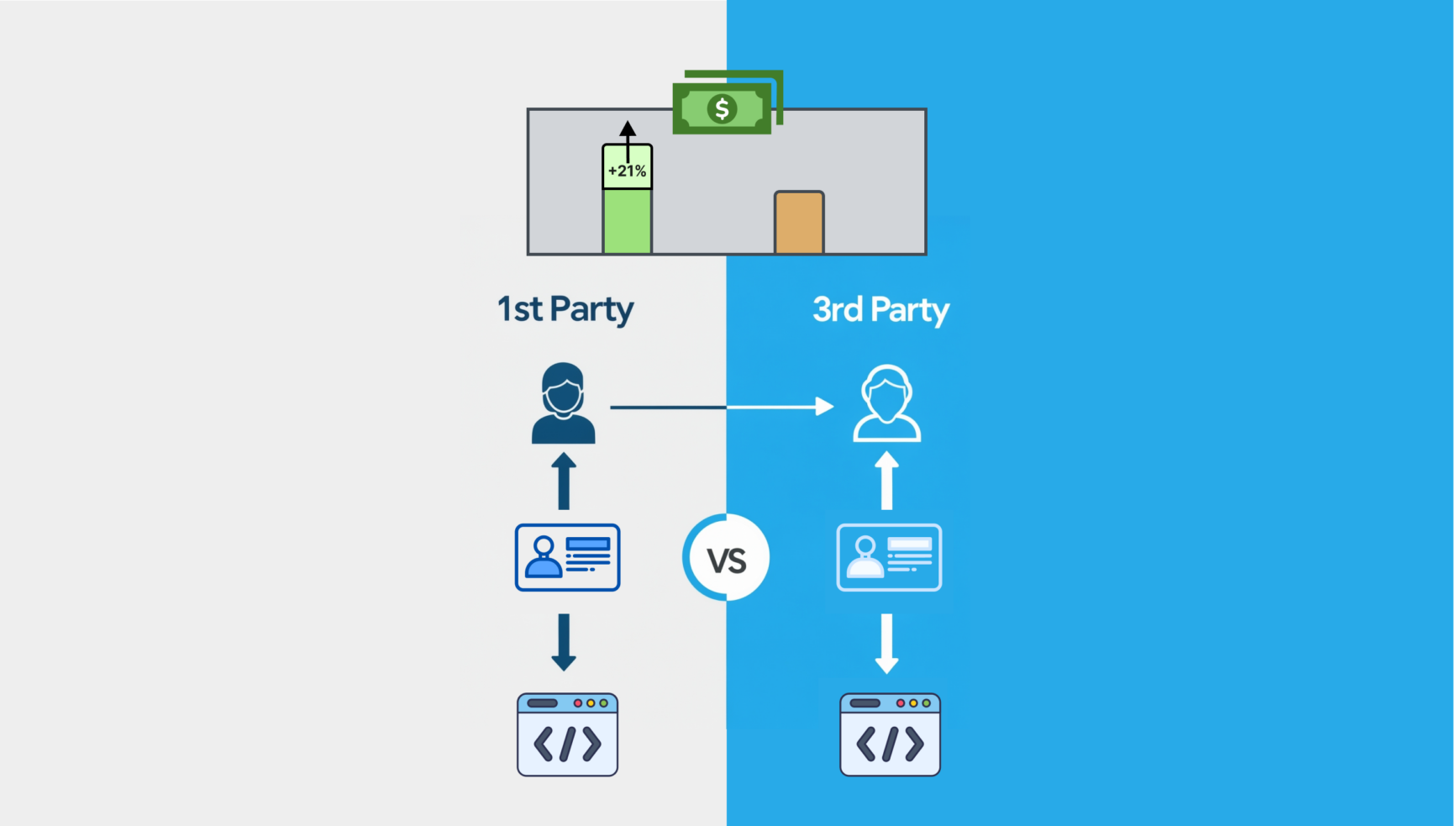

Software developer Norkon explained this past week how it helped all three with their “gamification” goals.

Content from our partners

Dagens Næringsliv attracted more than 21,000 users in 10 weeks, DI gained more than 17,000 new users and The Telegraph managed to increase subscribers by an unspecified amount.

While the case studies were interesting, I must admit that I rolled my eyes at the deliberate use of “gamification” to explain the publishers’ efforts in this area. Norkon describes gamification as the conversion of “a task or subject into a game-like activity”.

Let’s just call a spade a spade — game-like activities are just games. One of Merriam Webster’s many definitions of the word “game” is: “An activity engaged in for diversion or amusement”. Educational games remain games at the end of the day, though they may register lower on the fun scale for most.

The publishing industry has never been the quickest to adapt to change, with this being clearly displayed yet again at the glacial adoption of games. Given the amount of money on the table, it baffles me why more digital publishers are not experimenting with diversifying their subscription packages.