Since writing about Google News Showcase early last year, I’ve been pondering the difficult position publishers find themselves in concerning Meta and Google.

Publishers rely heavily on social media networks and search engines to help them reach new audiences. At the same time, the publishing industry has locked horns with Meta and Google, claiming they share stories without fair compensation. Admittedly, it is an incredibly distilled summary of their disagreement, but a fair one, I’d say.

Both tech giants have been increasingly noisy in refuting these allegations in recent years, with Meta’s skirmish with the Australian government in early 2021 a sign that the social media giant was in a position to escalate the matter.

Meta has been open about its belief that news isn’t a big enough piece of its business to justify being corralled into paying publishers for it. Indeed, the media network’s reported pivot away from news in July 2022 underscored this point.

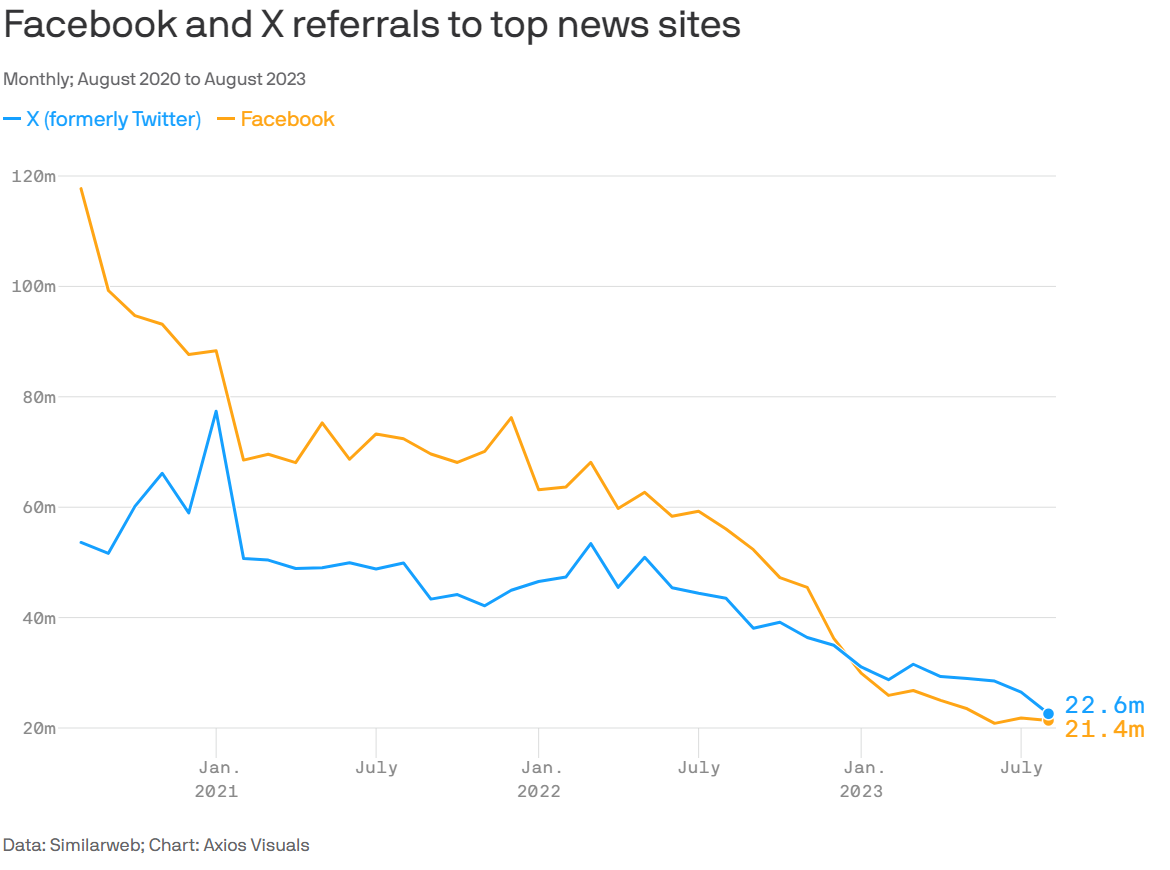

And yet, new figures reported this month illuminate precisely how detrimental this impact has been on publishing traffic.

Social Media Slide

We had some inkling in May as to the extent of the slide when several publishers revealed their referral traffic data as far back as 2018.

New data from internet analytics company Similarweb has brought greater clarity.

Source: Axios

The data, shared with several outlets, including Axios, shows the decline started months before Meta’s fight with the Australian government. This is important as it suggests two things:

- Either Facebook users were naturally pivoting away from, or

- Meta decided before mid-2022 to reduce Facebook’s news content

While I’d love to argue for the second option being part of Meta’s overarching masterplan, especially given that the tech giant still hasn’t blinked in its standoff with Canada, Occam’s razor demands that I keep it simple.

My reasoning is the similarly charted decline in news traffic from X (formerly Twitter). The data ignore the media industry’s distaste for Elon Musk, suggesting a downward trend existed long before Musk moved into Twitter HQ, kitchen sink and all.

One might almost say that social media users’ interest in news dipped after some significant event in January 2021. I wonder…

Anyway, back to the topic at hand. If publishers were already worried about the dominance of Google and Meta before, then losing Facebook traffic should set off major alarm bells for their audience acquisition teams.

Sure, TikTok is an option. But with its survival of the fittest algorithm (as well as issues around moving people off the platform), I doubt news publishers will be able to reliably build up enough referral traffic to offset losses from Facebook. Time will tell, though.

And what about the US government’s antitrust lawsuit targeting Google’s grip on the search market? It might help, but we shouldn’t hold our breaths.

A New Dawn for Search?

What does Google losing this case mean for the search landscape? The worst-case scenario for Google seems to be having to unwind its various contracts with browser developers, such as Apple and Mozilla, to ensure they use its search engine by default.

The Apple deal is undoubtedly the most controversial, with Google powering searches on Safari on iPhone, iPad and Mac, as well as the Siri and Search apps.

Microsoft CEO Satya Nadella even testified on October 2 that Google’s monopoly had effectively turned the internet into the “Google web”.

Google commands a more than 90% share of the global search market, while Bing has cornered slightly more than 3% since its launch in 2009.

Nadella even said Microsoft was prepared to lose up to $15 billion per year if Apple would switch over to Bing. I wonder why Apple, not exactly a small company in its own right, has opted to stay with Google.

Microsoft CEO of Advertising and Web Services Mikhail Parakhin has his thoughts, noting late last month: “My impression is that Apple doesn’t really consider switching … [T]hey use us as a bargaining chip against Google.”

Oh dear.

Microsoft isn’t competitive for the Apple search engine contract. And given that Parakhin has said it’s “uneconomical” for Microsoft to invest more heavily in mobile search — owing to Google’s mobile search being better and already having the Apple contract — this state of affairs doesn’t seem likely to change.

Over the years, the broader tech and media industry has speculated that Google is paying Apple to encourage it not to invest in search engine development.

Apple might surprise us all and launch its own search engine, but even if it does, why would the motivations of one profit-driven multinational differ greatly from others?

Content from our partners

That’s to say, I’m not convinced that Google losing all of its contracts will do more than postpone a return to this very same spot that publishers find themselves in now: lacking the means to engage audiences beyond existing channels.

A Possible Solution

So, what’s the answer? It’s time for several publishers to collaborate to create a publisher-led channel. A news hub app, if you will.

I know it sounds a bit far out, but I can’t see another viable option. Drifting from one owned channel to the next in pursuit of audiences doesn’t exactly scream that the golden age of publishing is nigh.

The digital revolution has never made it more feasible to launch a news aggregator created by publishers for publishers.

So many tech vendors are already pitching their wares to publishers that the software hurdle seems inconsequential. The proliferation of content recommendation engines suggests that building or buying something like Flipboard to create a publisher-owned channel is achievable.

But while the tech side of such a proposal seems achievable, I wonder if the most prominent publishers can look beyond their historic rivalries to create a more sustainable future for the broader publishing landscape.

In many ways, I suspect The New York Times is attempting to build a prototype ecosystem through acquisitions. News, features, analysis, sports, games and shopping recommendations all bundled together under one roof. But one publisher does not make an ecosystem; eventually, even The New York Times will see its growth slow and plateau.

How will it reach new audiences amid a shrinking number of discovery channels? It’s time for a new approach that addresses market reach by creating a new market platform.