What’s Happening:

The Economist released its 2019 annual report (operating on a fiscal year that ends March 31). Overall, the report shows that revenue hit a record high for the media brand, though it only grew by 1.3%. The Economist remains on stable ground financially, with areas of concern being slowed revenue growth in spite of the record high total, and an operating margin that fell for the third year in a row (down 3% for 2019).

Why it Matters:

As one of the oldest news publishers around, in business since 1843, the financial health of The Economist can provide insight for other publishers. The annual report illuminates what may or may not be working for the company as it continually shifts in the changing digital landscape.

Digging Deeper:

Some of the key data from the report include:

- Revenue for the fiscal year 2019 hit a record high of £333 million, up £4M from last year and compared to £278 million revenue in 2015.

- Operating profit, however, is way down — £31 million in 2019, compared to £38M in 2018 and down from £47M in 2015. The primary cause for this decrease is troubling: an increased marketing budget to £56M-plus did not translate to as many new paying subscribers as predicted.

- While total paying subscribers increased by 13,000 to 1,123,000 and subscription revenue increased by 3%, this was not enough to offset the 14% increase in marketing expense.

- The Economist report gives several factors affecting the lower-than-expected subscriber numbers: news and subscription fatigue, lower social media traffic, and fewer conversions of trial users to paid subscribers. One of the main reasons subscribers do not renew is that they find the amount of content overwhelming.

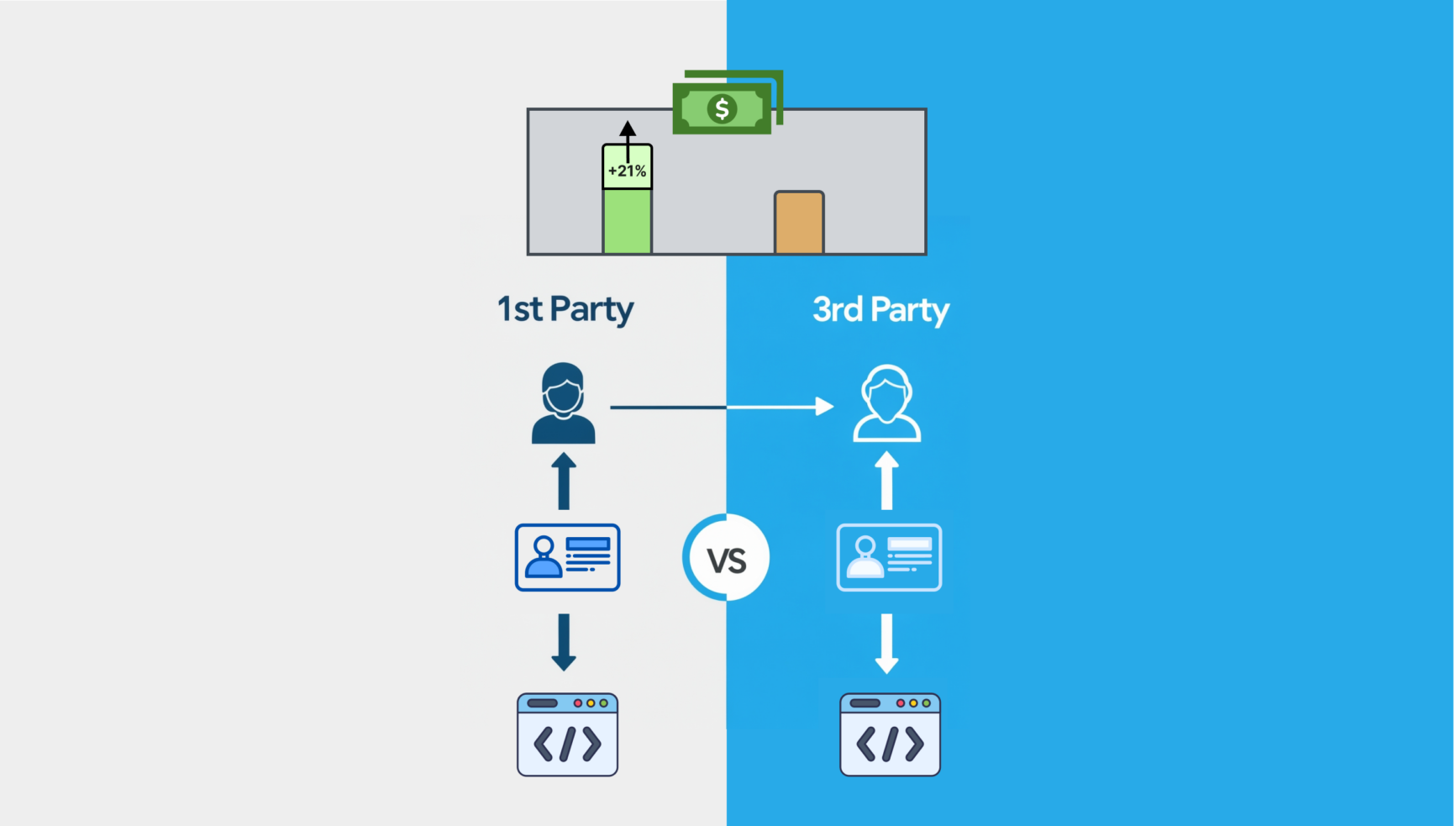

- Retention remains The Economist’s top strategic priority, and the report reflects some focus on that goal: average lifetime value was up 21% in 2018. However, the 2019 report notes a change in the subscriber renewal process that does not state explicitly if this resulted in increased churn rates but suggests it.

- One interesting area to watch will be the recent price increase, its first in three years after research indicated that The Economist audience perceived the magazine to be more valuable. Seeing what happens with churn and new subscriptions after this increase will be telling.

- The Economist’s reliance on revenue from digital platforms such as Google and Facebook has diminished considerably, now constituting only 17% of revenue.

The Bottom Line:

Paul Deighton, chairman of The Economist, said that these marketing and technology expenditures are long-term investments, and the resulting profit decrease expected. “In the context of a continuing difficult environment for business—and media business in particular—this was no surprise,” Deighton wrote in the report.

The Economist, like most publishers today, has many fronts on which to do battle for increased subscriptions and retention. Addressing news fatigue and information overload is key, and the company is attempting to address that with streamlined apps and newsletters to make content more streamlined and accessible. It is also increasing social media reach, particularly in areas such as Instagram Stories, and launching ancillary products and platforms such as YouTube series and podcasts.