Virginie Dremeaux is VP, Marketing & Communications, International at FreeWheel, a Comcast company that combines the targeting and measurement of digital with the scale and quality of linear TV.

Over just a few years, Virginie’s role has expanded to include various responsibilities at a senior-management level in marketing, product marketing, event marketing, thought leadership and advocacy, as well as communications and PR.

Virginie is also responsible for leading and expanding the marketing team to support FreeWheel’s sales efforts, developing go-to-market strategies for FreeWheel’s technology and new media offerings for agencies and brands.

What led you to start working in the tech and media industry?

I’m passionate about the power of content and aware of the crucial role of the advertising business model in maintaining free access to it. Before joining FreeWheel, I spent my career in TV media, particularly the advertising side, witnessing and also helping to drive digitisation – to enable new usage, new distribution, and new data and advertising capabilities.

Helping media companies create and maintain the right conditions for a sustainable ad-supported business model is very important. Not everyone can afford to pay for access to quality editorial content, so we need to support this opportunity to access free, high-quality information for consumers. This is crucial in such a fast-evolving world, where information is often accessed through social networks or content aggregators, and there is a risk that objectivity and diversity of viewpoints may not be guaranteed.

How did this lead you to join freewheel?

After many years working for a major European broadcaster, I wanted a new challenge, but also to continue to play a significant role in the development of this thriving industry. As I had the opportunity to work with FreeWheel, I was convinced that FreeWheel and Comcast Advertising were key partners to help drive the entire ecosystem – programmers, operators, and marketers – in the right direction. My goal upon joining FreeWheel was to gain perspective on the global transformation of the TV industry and to help create the best tech and marketing tools to help European markets in their evolution.

What does a typical day look like for you? What does your work setup look like? (apps, productivity tools, etc.)

In the past 18 months, I have worked 100% remotely, from my home (or other places in France!) and I will probably soon have to return to the office. I usually start my day with a quick check of emails and Slack – working within a US company means things can change during the night. Then I read the different industry newsletters and start to connect with my team, checking in on project updates. Having teams in the US and the UK has been a huge advantage in adapting to the work-from-home era. We were already used to virtual meetings and collaborating on shared documents online. We’re making the most of many tools in addition to Slack, such as Teams, WebEx, Zoom, Sharepoint, and we’re evolving all the time to take advantage of new trends.

What changes have you seen in the media industry since the pandemic and why?

Thanks to new digital touchpoints, media consumption has been evolving very rapidly over the past few years, and the pandemic has been a huge catalyst and accelerator of that change. This has led to greater audience fragmentation, as consumers have spent more time at home, discovering new content providers and new ways of accessing this content, such as through Connected TV (CTV) screens.

These changes have prompted the media industry to develop new, sustainable ad business models and create opportunities focused on where eyeballs are now. At the same time, marketers must maintain their ability to reach and optimise at scale against their targets, while adapting to new KPIs and increased complexity in measurement and targeting.

The media industry has made great steps forward. In the past few months, for example, we’ve seen the launch of CFlight, where Channel 4 and ITV are joining Sky to collaborate in a key measurement initiative in the UK.

Why is connected tv (CTV) relevant for broadcasters now?

Between January and September 2020, in the US, ad revenue declined across most “traditional” media channels, yet revenue from CTV ads increased by 17% over this same period according to a study conducted in January 2021 by The Trade Desk and YouGov.

This revenue growth is perhaps not surprising in light of the recent rapid increase in the proportion of TVs connected to the internet, which we found in our recent study with the consumer-focused market research company, Happydemics, that explored how increased connectivity translates in the European TV market. We discovered that 70% of consumers surveyed across the UK, France, Italy, and Germany have connected their TV sets to the internet. And the figure is actually higher in the UK and France specifically, at 80% and 77% respectively.

With such strong growth in the number of viewers watching CTV screens, along with the potential revenue growth of CTV inventory, it is important broadcasters take note of this trend.

What are the advantages of CTV?

Turning to our recent research once again, consumers seem to enjoy the experience they have with CTV screens. In fact, 53% of those surveyed cited this as their preferred screen for viewing video content. When asked the reason behind the preference, over half of respondents (55%) claim CTV screens offer an enhanced user experience, due to size, better sound, a simpler user interface and greater content choice. Another reason is the ability to watch with friends and family (44%), rising to 55% in Italy, where the shared viewing experience is particularly valued.

CTV inventory is also becoming more in demand from media buyers because it can be an incredibly effective way to boost KPIs. The same study reveals 57% of consumers surveyed in the UK, France, Italy and Germany pay more attention to ads on their CTV screens than on other devices, with 54% of respondents saying they find the ads less intrusive than on other screens.

How can broadcasters expand their CTV offerings to get the most from advertisers?

We know, from our 2020 CoLab survey, that the top three reasons marketers surveyed in the UK, Italy, France Germany and Spain give for spending more on advanced TV advertising – including CTV inventory – are that it maximises campaign efficiency, as well as delivering better consumer data at the individual – not household – level, and provides an opportunity to manage the frequency of exposure to TV campaigns. In addition, over half of marketers surveyed also recognise other key drivers, such as extending the reach of traditional TV, cross-screen targeting opportunities, reaching new audiences, and higher ad effectiveness.

On the other hand, top inhibitors to marketers surveyed investing in advanced TV advertising – including CTV inventory – relate to measurement; such as a lack of accurate tools for measuring audiences and campaign effectiveness. This indicates that robust measurement solutions and standards for advanced TV could soon be a top priority across the industry. Other inhibitors identified in the survey are a perceived difficulty in managing advanced and linear TV campaigns at the same time, and a lack of awareness about what advanced TV actually is, and the belief that it’s too expensive.

Content from our partners

While the outlook for advanced TV platforms on CTV across Europe is impressive, paving the way for a year of strong growth, greater clarity in the industry about the strengths of CTV screens and advantages with the inventory would help make the most of this momentum. There are varying perceptions around drivers and inhibitors that could be addressed, to allow CTV to fulfil its potential during the year ahead.

Measurement across different channels and devices continues to be a challenge. What can broadcasters do to address this?

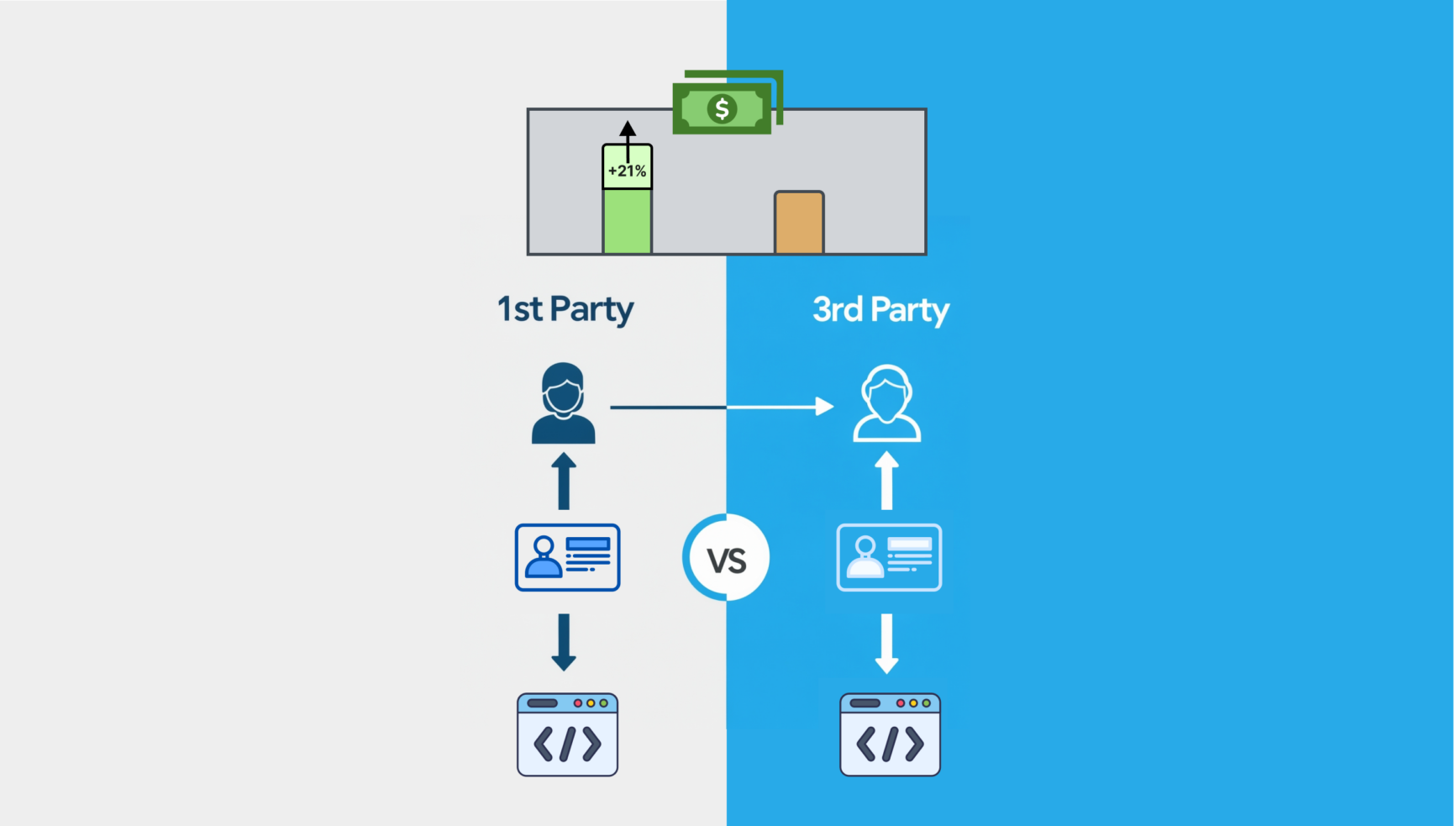

Good question! I don’t think the ball is solely in the broadcasters’ court, but a unification of ad IDs across channels and devices is an effective and necessary first step.

How is CTV set to evolve and what will that mean for broadcasters?

There will likely be more and easier ways to interact with TV viewers. For instance, the remote control is not always used optimally, and voice control could become a game-changer in the future. For broadcasters, that would mean a better ability to display interactive ad campaigns – across a range of different ad formats – and provide richer insights at the same time.

What’s the challenge that you’re passionately tackling at Freewheel at the moment?

Apart from the importance of facilitating the access and trading of CTV inventory, especially through premium programmatic, the need to make the advertising business sustainable is a huge topic emerging in Europe. But rather than a problem, this is an opportunity, both for marketers and publishers, to work hand-in-hand to develop and provide solutions that will help reduce their carbon footprint, and therefore meet consumers’ concerns and expectations. As we’re a part of this ecosystem, our duty is to support this positive trend and make sure our solutions are aligned with the requirements of responsible and sustainable ad campaigns.