18 Best Ad Networks for Publishers in 2026

Top Picks

Disclaimer: Our top picks are based on our editors’ independent research, analysis, and/or hands-on testing.

Ask ChatGPT

Ad revenue represents one of the three monetization pillars publishers have access to — with the others being subscriptions and affiliate marketing. As such, those publishers that have prioritized ad revenue need to ensure they pick the right ad network.

The global digital advertising market is projected to hit around $1.3 trillion by 2027, driven by factors such as the growing adoption of smartphones and the ongoing rollout of the Internet of Things (IoT).

The role of digital advertising remains pivotal to brand strategies, with research showing that around 50% of online users search for a product video before making a purchase.

The growth of digital advertising and how mobile ad networks work offers immense monetization opportunities for publishers that are in a position to capitalize. A key element of that positioning is the ad networks they choose.

When choosing an ad network, it’s important to consider the ad formats available, the targeting options, the optimization tools and the revenue share.

What Is an Ad Network?

Ad networks are online advertising intermediaries that broker deals between publishers who want to display ads and businesses that want to place them.

Ad networks mainly solve the publisher’s risk of having unsold ad units. They collect unsold inventory from multiple publishers and sell it in aggregated packages to advertisers.

This allows the ad network to offer more high-quality ads and ad impressions to advertisers than a single publisher could provide and consequently charge a higher price for the ad space. In turn, the ad network passes on a share of the revenue to the publisher.

In a nutshell, ad networks benefit both sides by providing a service that makes it easier for advertisers to reach their target audience and for publishers to monetize their unsold inventory.

How Does an Ad Network Work?

Step 1: Pooling Inventory From Publishers

An ad network collects unsold inventory from multiple publishers and stores it in a central location. The most popular ad networks, such as AdSense, only choose high-quality websites to work to maintain maintain ad inventory quality. The selected publisher, in turn, puts an ad network’s tag or a snippet of code in their website’s HTML code.

Step 2: Getting Campaign Details From Advertisers

Ad buyers create a campaign in the ad network’s campaign management panel, or the ad network can manage the campaign on behalf of an advertiser or ad agency.

In both cases, the ad network needs to receive information from the advertiser about their advertising campaign , such as their target audience, budget and what kind of ads they want to display — e.g., image, video or text.

Step 3: Selecting the Right Inventory for Advertisers

Once the advertiser’s campaign requirements match the publisher data, ad details are sent to the publisher via the ad network’s ad server and with the help of the previously-inserted ad tag that is responsible for calling the ad.

Step 4: Tracking Ad Performance

Ad performance is tracked via the ad network’s tracking pixel, which is placed on the advertiser’s conversion page(s).

Ad networks earn money either by taking a portion of ad revenue or by initially marking up the inventory of the publisher. Publishers are primarily paid according to the number of ad clicks, impressions or conversions.

Why Are Ad Networks Important?

Segregation

Ad networks segregate inventory collected from multiple publishers and segment it based on demographics. This allows advertisers to select their target audience more accurately instead of blindly placing their ads.

Specialization

Some ad networks specialize in a single ad format, such as display ads, and videos. This allows publishers in specific niches to work only with networks that offer the most appropriate ad placements for their website content and audience.

On the other hand, advertisers benefit from specialized ad networks in the confidence that their ads will be placed on websites with similar content, resulting in better chances of conversion.

Time Savings

Advertisers no longer need to look for individual websites to place their ads, while publishers gain leads by simply signing with an ad network instead of looking for advertisers.

Additionally, advertisers do not sign separate orders for different publishers but rather work with one ad network that has a contract with many publishers.

Reach and Measurement

Campaigns are much easier to measure as results are aggregated. Ad networks offer reporting tools that show a campaign’s performance in terms of reach and impressions. This allows advertisers to make changes necessary to improve their campaigns without tracking each publisher’s efficiency separately and comparing the results.

How Ad Networks Benefit Publishers

Effectiveness

Ad networks have direct relationships with advertisers and demand-side platforms (DSPs), enabling them to aggregate demand and sell inventory in bulk.

Monetization Methods

The best ad platforms and ad networks provide monetization solutions for a variety of ad formats, such as display ads, video ads and native ads. This gives publishers more options to generate revenue from ad inventory than working with a single advertiser.

Higher ROI

The prices set by ad networks are generally higher than what publishers could secure on their own for unsold inventory.

This is mainly because ad networks can provide bulk impressions to advertisers, which are then passed on to publishers through higher cost per 1,000 views (CPM), which we’ll delve into a little later on.

Better Targeting

Ad networks have access to large amounts of data they can use to target ads more effectively. This results in higher click-through rates (CTRs) and conversion rates, leading to higher revenue for publishers.

Google AdSense, for example, is one of the largest ad networks with more than 2 million advertisers.

4 Different Types of Ad Networks

Here are the four main types of networks publishers can use to generate ad revenue.

Premium Ad Networks

A premium ad network works exclusively with big brands and well-known companies to provide high-quality traffic at a higher price.

The advantage of working with such networks is that publishers can access big budgets and high-converting ad campaigns. The downside is that it can be hard to secure a premium network’s approval as they are very selective with the inventory they offer to advertisers.

Examples:

Vertical Ad Networks

A vertical ad network focuses on a specific industry or niche, providing access to websites that are related to this particular niche, such as healthcare, finance and travel.

Examples:

Inventory-Specific Ad Networks

Inventory-specific ad networks for publishers provide access to a specific type of inventory, such as video, mobile or rich media ads.

Examples:

Affiliate Ad Networks

Affiliate ad networks provide performance-based advertising, meaning the publisher is only paid for ad conversions.

These ad networks connect content creators, bloggers and other online publishers with companies ready to pay for the promotion of their products or services.

Examples:

How to Choose the Best Ad Network

Here are some factors to consider when choosing the best ad network.

Size

Though there is no single accurate measure of an ad network’s size, one can gauge this by the number of advertisers and publishers the ad network already has in its system.

Reputation

Popular ad networks, such as AdSense and AdRoll, have been around for many years and have built a solid reputation within the industry. However, when operating with lesser-known ad networks, it’s necessary to check their reputation and read reviews before signing a contract.

Quality of Ads

It’s essential that publishers carefully scope out the type of advertisers that the ad network works with, as this will determine the quality of the ads publishers will be expected to display on their websites. Ad quality is usually determined by a website’s content quality, relevance and design.

For publishers to ensure they’ll receive high-quality and contextually relevant ads, they should check the ad network’s advertiser requirements.

Compensation Model

The most common compensation models are cost per click (CPC), cost per mille (CPM) and cost per action (CPA).

With the CPC model publishers are paid every time a user clicks on an ad. Revenue varies depending on the type of the product being advertised, the platform, the ad as well as the niche.

With the CPM model, publishers are paid based on the number of impressions the ad receives, regardless of whether it was clicked or not. The CPM rates largely depend on the website’s traffic, the main audience’s location and the CTR. The CPM for display ads usually fluctuates between $0.30 and $2.

Finally, with the CPA model publishers are only paid if a user takes a specific action, such as filling out a form, signing up for a newsletter.

18 Best Ad Networks for Publishers in 2026

We have listed some of the best ad networks for publishers to help you find the one that meets your requirements.

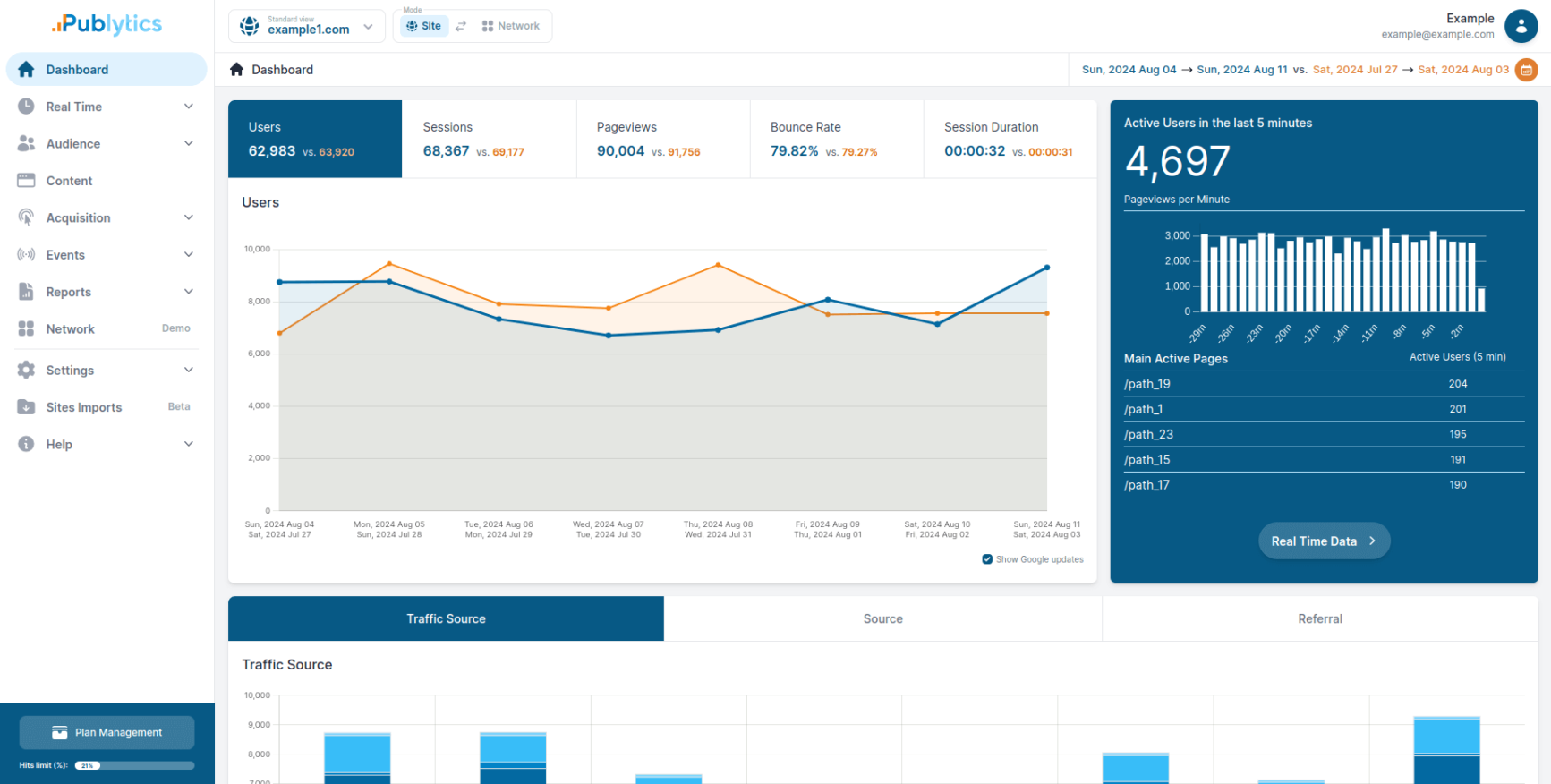

| Network | Revenue | Ad Quality | UX | Tech | Payment | Brand Safety | Control | Reputation | Weighted Score | Velocity | Operational Load (1=easier,5=heavier) | Small Pub Fit | Mid Pub Fit | Large Pub Fit | Market Fit Score |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mediavine | 4.5 | 5 | 5 | 4 | 4 | 5 | 4 | 5 | 4.7 | 4 | 1.5 | 4.15 | 4.60 | 4.70 | 5.00 |

| Raptive (AdThrive) | 5 | 5 | 4.5 | 4 | 4 | 5 | 4 | 5 | 4.7 | 4 | 1.5 | 4.68 | 4.60 | 4.70 | 5.00 |

| Google AdX (via GAM) | 5 | 5 | 4 | 5 | 4 | 5 | 4 | 5 | 4.9 | 5 | 2 | 3.48 | 4.41 | 4.54 | 5.00 |

| Opti Digital | 4.3 | 5 | 4.5 | 5 | 4 | 5 | 5 | 4 | 4.6 | 5 | 2.5 | 2.63 | 4.48 | 4.56 | 4.86 |

| MonetizeMore | 4.5 | 5 | 4 | 5 | 3.5 | 5 | 5 | 5 | 4.6 | 5 | 2.5 | 2.63 | 4.48 | 4.55 | 4.85 |

| Aditude | 4.3 | 4.5 | 4 | 5 | 4 | 5 | 5 | 5 | 4.5 | 5 | 2.5 | 2.63 | 4.48 | 4.49 | 4.79 |

| Publift | 4 | 5 | 4 | 4.5 | 4 | 4.5 | 4 | 5 | 4.2 | 4.5 | 2.5 | 2.63 | 4.41 | 4.22 | 4.52 |

| Ezoic | 4 | 4 | 3 | 4.5 | 4 | 4 | 5 | 4 | 4.0 | 4.5 | 3 | 3.88 | 4.09 | 4.25 | 4.25 |

| Freestar | 4 | 4.5 | 3.5 | 4.5 | 4 | 4 | 4 | 4 | 4.1 | 4.5 | 3 | 2.48 | 4.26 | 4.29 | 4.29 |

| Playwire | 3.8 | 4 | 3.5 | 4 | 4 | 4 | 4 | 4 | 3.9 | 4 | 3 | 2.48 | 4.26 | 4.03 | 4.03 |

| AdPushup (Zelto) | 3.8 | 4 | 3.5 | 4 | 4 | 4 | 4 | 3 | 3.7 | 4 | 3 | 2.48 | 4.26 | 3.96 | 3.96 |

| Media.net | 3.5 | 4 | 4 | 4 | 4 | 4 | 3.5 | 4 | 3.8 | 4 | 3.2 | 2.24 | 3.54 | 4.07 | 3.95 |

| Sovrn | 3.3 | 4 | 4 | 4 | 4 | 4 | 3.5 | 3.5 | 3.7 | 4 | 3.2 | 2.24 | 3.54 | 4.02 | 3.90 |

| Index Exchange | 3.5 | 4.5 | 4 | 4.5 | 4 | 4.5 | 4 | 4 | 4.0 | 4.5 | 3.2 | 2.24 | 3.54 | 4.33 | 4.21 |

| TripleLift | 3.4 | 4.5 | 4 | 4 | 4 | 4.5 | 4 | 4 | 3.9 | 4 | 3.2 | 2.24 | 3.54 | 4.10 | 3.98 |

| Vuukle | 3 | 3.5 | 4.5 | 3 | 4 | 4 | 3.5 | 4 | 3.4 | 3 | 1.5 | 4.15 | 4.15 | 3.80 | 3.93 |

| AdMaven | 2.5 | 2.5 | 2.5 | 2.5 | 3 | 1.5 | 2 | 2 | 2.4 | 2.5 | 4 | 2.18 | 2.18 | 3.15 | 2.55 |

| Adsterra | 2 | 2 | 1.5 | 2 | 3 | 1.5 | 1.5 | 2 | 1.943 | 2 | 4 | 2.18 | 2.18 | 2.77 | 2.17 |

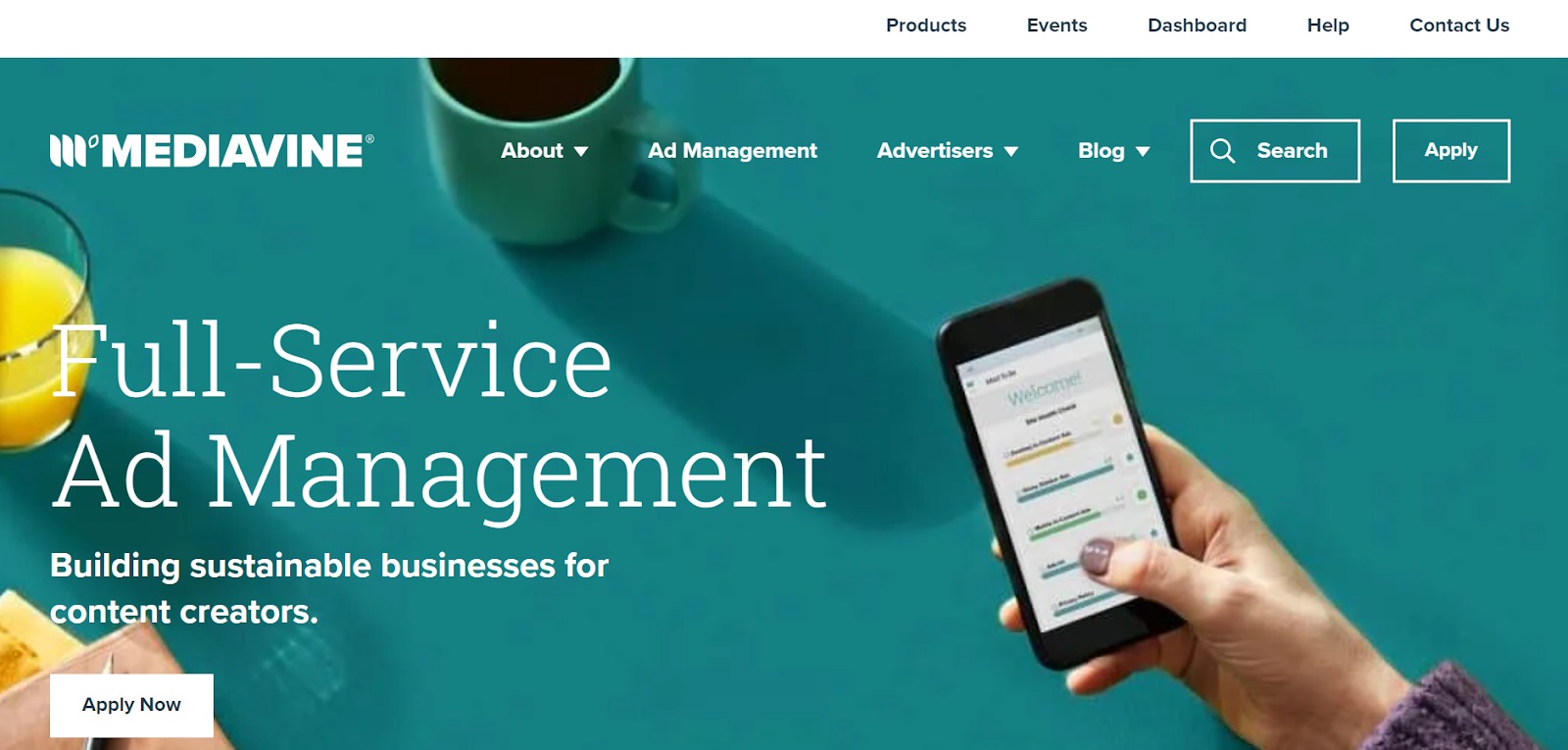

Mediavine

Mediavine is a premium ad network that’s especially popular among lifestyle and food bloggers, though it welcomes publishers across various niches. The platform prefers working with publishers who have a majority of their traffic coming from Tier 1 countries like the US, Canada, UK, and Australia.

Mediavine operates exclusively on a CPM (revenue share) model, so it won’t be suitable for bloggers looking to work with CPC or CPA pricing. One thing to note is their payment schedule—Mediavine pays on a NET 65 basis, meaning you’ll receive your earnings 65 days after the end of the month they were generated. Mediavine launched Journey, a sister program designed for smaller publishers who have around 10,000 sessions per month or more, with some acceptance at lower traffic levels.

Model: CPM

Minimum Traffic Requirement: 50,000 sessions or around 60,000 pageviews per month

Features

- Exclusive ad partnerships with leading premium advertisers

- Wide range of ad formats

- Site speed optimization through lazy loading and asynchronous ad loading for fast page performance

- Comprehensive analytics with real-time insights and transparent revenue tracking

Pros

- Impressive user experience with fast-loading

- Strong focus on site speed optimization that protects Core Web Vitals and SEO rankings

- Exclusive advertiser relationships typically generate higher CPMs

Cons

- Operates exclusively on CPM model, no support for CPC or CPA pricing

- Payment schedule runs on NET 65 (65 days from the end of the earning month)

- Prefers majority traffic from Tier 1 countries, which may impact acceptance for publishers with global audiences

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Raptive (formerly AdThrive)

Raptive (formerly AdThrive until April 2023) is a premium ad network that primarily focuses on lifestyle publishers and bloggers. An open platform for different niches, it works best for food, travel, home, DIY, and parenting categories. This network promises at least a 15% RPM lift for publishers moving from other networks; this offer lasts for two full calendar months for sites earning $12K-$99.9 annually or three months for those earning $100K+. It is ideal for established lifestyle publishers with heavy Tier 1 traffic who want strong RPMs and payment protection.

Model: CPM

Minimum Traffic Requirement: 25,000 monthly pageviews

Features

- Full-spectrum solution-ad placement, optimization, ad sales, and more

- Premium display advertising with unique advertiser partnerships

- Custom ad design services and personalized layout optimization

- Payment guarantee protecting publishers from advertiser non-payment

Pros

- Publisher payment guarantee independent of advertisers’ non-payment

- Strong performance and high RPMs for lifestyle content

- Strong user experience that strengthens credibility

- 75% Revenue Share with transparent reporting

Cons

- Best for lifestyle niches; may underperform in other verticals

- Geographic restrictions favour Tier 1 countries.

- Demands users to exhibit commitment by exclusively sticking to their ads

- NET 65 payment schedule high traffic threshold excludes smaller publishers

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Google AdX (via GAM)

Google Ad Exchange (AdX) is a real-time marketplace where publishers sell their ad inventory to multiple ad networks and advertisers through real-time bidding. Accessible through Google Ad Manager, which combines features from DoubleClick for Publishers and DoubleClick Ad Exchange, AdX represents the premium tier of Google’s advertising ecosystem. Unlike AdSense, AdX operates on an invitation-only basis, targeting publishers with substantial traffic and high-quality content.

It is best suited for large publishers generating significant traffic from Tier 1 markets who need access to premium advertiser demand and have dedicated ad operations resources.

Model: CPM

Minimum Traffic Requirement: No minimum value, 5 million monthly pageviews for premium tiers

Features

- Access to multiple auction types

- Comprehensive ad management platform offering granular controls and support for multiple ad exchanges and networks

- Advanced reporting and analytics tools tracking key metrics, including ad impressions, clicks, revenue, and eCPM

- Real-time bidding marketplace connecting publishers with premium advertisers

Pros

- Access to premium advertiser demand typically offering significantly higher CPMs

- Publishers utilizing AdX’s dynamic flooring, Google Open Bidding, and preferred deals can expect 20-50% revenue increases

- Seamless integration within Google Ad Manager allows unified management of direct sales and programmatic inventory

- Full transparency with publishers maintaining complete control over pricing rules, inventory settings, and ad delivery

Cons

- Requires an existing Google Ad Manager account and technical expertise to manage complex header bidding configurations effectively

- Significantly more challenging and complex to manage and optimize

- Access through third-party MCM partners typically costs 10-20% of monthly AdX revenue

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Opti Digital

Optidigital is a premium ad monetization platform designed for publishers who prioritize revenue optimization and site performance. The ultra-lightweight ad stack of the platform upgrades site speed and user experience. Its ad stack is much lighter than standard solutions, turning it into an extremely attractive proposition for European publishers interested in SEO rankings and user experience. It best suits mid-to-large publishers with significant European traffic in need of performance-first monetization without page speed compromises.

Model: CPM

Minimum Traffic Requirement: Not publicly disclosed

Features

- AI-driven dynamic price flooring optimized in real-time across more than 27+ signals

- Proprietary Core Web Vitals protection to prevent layout shifts and maintain SEO

- Hybrid header bidding that combines client-side and server-side auctions

- Opti Engage Native Ad Format with social media-inspired design

Pros

- Exceptional attention to page speed and Core Web Vitals

- Strong CLS compared to traditional systems

- Consistently achieves viewability rates above 70% across all devices.

- Strong GDPR-compliant, cookieless monetization for European markets

Cons

- Has specific traffic geography and volume requirements that may exclude smaller publishers

- Stronger presence in Western Europe than other regions

- May require access to Google Ad Manager for some advanced functionalities

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

MonetizeMore

MonetizeMore is a full-service ad monetization platform catering to mid-to-large publishers for advanced ad operations management that optimizes revenue. As a Google Certified Publishing Partner, the platform uses top-notch technology in concert with ad operations support to deliver hands-on revenue optimization. Its flagship PubGuru header bidding wrapper provides the technical backbone, while the overall success largely hinges on the quality of ongoing ad ops management and optimization performed by the team.

Model: CPM

Minimum Traffic Requirement: 500,000 monthly pageviews or a minimum $1,000 monthly ad revenue

Features

- PubGuru header bidding wrapper connecting publishers with 50+ premium advertising partners

- Traffic Cop invalid traffic detection using machine learning and fingerprinting algorithms protects your revenue and keeps your account from being suspended.

- AI-driven dynamic floor pricing and bid optimization controlled by real-time auction technology.

- A dedicated ad operations team offering customized layout optimization

Pros

- Publishers typically see 50-300% revenue increases compared to AdSense alone

- Full-service approach with hands-on ad ops support and custom optimization strategies

- No contract lock-ins with a 30-day termination notice period

- Strong management of header bidding

Cons

- Requires at least $1,000 of ad revenue a month for eligibility for certain packages, which may limit some smaller publishers

- Revenue performance is heavily dependent on the quality and responsiveness of the assigned ad ops support team

- Takes a revenue share that is competitive with managed-service alternatives

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Aditude

Aditude is a SaaS-based ad monetization platform designed for publishers who need both advanced technology and hands-on support to maximize programmatic revenue. The platform’s flagship Cloud Wrapper is lightweight, delivering exceptional page speed without sacrificing revenue optimization. With strong expansion across North America and recent growth into European markets, Aditude has positioned itself as a publisher-first platform that combines proprietary technology with dedicated ad operations expertise. It is best suited for mid-to-large publishers with significant traffic from North America and other Tier-1 markets who want control over their ad tech stack without requiring extensive in-house technical resources.

Model: CPM

Minimum Traffic Requirement: Not publicly disclosed

Features

- Lightweight Cloud Wrapper supporting 50+ premium demand partners with no-code UI for centralized management

- Real-time dynamic price flooring that accounts for time of day, seasonality, geo, and contextual variables

- Built-in video player supporting both in-stream and out-stream formats without requiring separate technology

Pros

- Exceptionally lightweight header bidding wrapper (90% smaller)

- No-code Cloud Wrapper UI enables ad ops teams to make changes without developer dependencies

- Publishers typically see 20%+ revenue uplift through optimization and ad ops management

Cons

- While traffic requirements aren’t publicly disclosed, the platform focuses on established publishers with substantial traffic

- Primary market strength remains in the US and Canada, with European presence still developing

- Success depends on the quality of the ongoing partnership with ad ops team

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Publift

Publift is a premium ad monetization platform serving publishers around the world. Some of its major clients include various mid-sized publishers. With Google certification as a publishing partner since 2016, it is accredited by Google to help publishers be successful with Google AdSense and Google Ad Manager. Publift works best with publishers whose majority traffic comes from North and South America, Europe, or Australia/New Zealand. It’s ideal for mid to large-sized publishers seeking a full-service header bidding solution with strong support, particularly those with high-quality content from Tier 1 English markets.

Model: CPM

Minimum Traffic Requirement: 500,000 monthly pageviews or $2,000+ monthly ad revenue

Features

- Fuse header bidding solution that provides access to more than 30 premium demand partners

- Machine learning-powered optimization for ad revenue maximization

- It supports several ad formats, such as display, video, and native ads

- Quality control through advanced ad blocking

Pros

- Publishers typically see 40-70% revenue uplift from managed header bidding

- Google Certified Publishing Partner and committed support

- No lock-in contracts

- Transparent reporting with a detailed analytics dashboard

Cons

- Best suited for traffic from Tier 1 regions

- Revenue share model for some publishers is less attractive compared with fixed-fee alternatives

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Ezoic

Ezoic is a Premier Google Certified Publishing Partner, one of only four companies globally to hold this designation as of December 2025. It is also a certified partner of Trade Desk One Path, Cloudflare, JW Player, and the Flipa marketplace. It was initially conceptualised as an ad-testing platform that enabled publishers to optimize ad placement, format, size, and location using machine learning. Presently, many publishers utilise Ezoic as a strategic revenue platform to continue layering new revenue avenues and to optimize ad supply through its ad management technology, services, and customizable modules focused on industry trends, including first-party data strategies and rewarded ad formats tailored to individual websites and web applications. Ezoic aims to build a monetization framework for the open web by leveraging emerging technologies to optimize the supply chain for all leading ad demand holistically.

Model: CPM

Minimum Traffic Requirement: 250,000 monthly active users.

Features

- Machine-learning ad optimization testing thousands of layouts, placements, sizes, and formats.

- Automated multi-variable testing across placement, density, format, and UX metrics.

- ezID first-party identity integration linking publisher data with ad-ID protocols.

- Native Google One-Tap and Rewarded Ads support.

- Automated supply-path optimization (SPO).

- Scope3 and premium demand aggregator integrations.

- Integration with nearly all major ad networks.

- Big Data analytics with EPMV tracking.

- Privacy-first monetization infrastructure.

Pros

- Premier Google Certified Publishing Partner status provides enhanced support and early access to beta features

- Automated AI testing reduces manual optimization work for publishers

- Free plan and 30-day trial with no minimum commitment; long-term agreements available with negotiated take rates, guarantees, and commercial terms.

Cons

- Increasing traffic and tool suite requirements may limit suitability for smaller and startup publishers.

- User experience depends on the publisher’s optimization settings and site configuration, though most work with a specialist support during setup.

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Freestar

Freestar is a full-service ad monetization platform providing comprehensive ad management alongside professional audience development support. Complementing standard ad optimization, its audience development team offers SEO consultations, group traffic sessions, content strategy, and growth strategies to help publishers increase web traffic and maximize their earnings.

A notable success story is Doodle, which was able to increase its RPM by 123% after partnering with Freestar. It’s best suited for mid-to-large publishers seeking a managed header bidding solution with dedicated audience development support.

Model: CPM

Minimum Traffic Requirement: 1 million monthly pageviews (6 months of historical traffic data).

Features

- Professional audience development, including SEO consultations, traffic growth strategies, and content planning.

- Proprietary header bidding platform with access to 30+ premium demand partners

- Advanced ad placement technology, including dynamic ads for long-form content

- Google Analytics integration

Pros

- Dedicated audience development team

- World-class yield management experts provide ongoing optimization

- NET 60 payment schedule via Tipalti or PayPal

Cons

- High traffic requirement excludes the smaller publishers

- Moderate script overhead

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Playwire

Playwire is a publisher-first ad technology platform and managed service provider that combines comprehensive demand access with full-service ad operations support. Founded in 2007, the company differentiates itself through direct publisher relationships, premium demand partnerships across gaming, entertainment, and education verticals, along with its unified platform approach to handle everything from header bidding to direct sales. The RAMP (Revenue Amplification Management Platform) integrates AI-driven optimization with dedicated yield operations teams, thus making it fit for mid-to-large publishers that aim for hands-off monetization without sacrificing either transparency or control.

Model: Revenue Share (CPM-based)

Minimum Traffic Requirement: 500,000 monthly pageviews (websites) or 1,000 daily active users (apps)

Features

- Access to more than 30 SSPs and DSPs, including Google AdX, Amazon TAM/UAM

- Dedicated yield ops teams perform ad stack management, optimization, and troubleshooting 24/7

- Proprietary algorithms make real-time adjustments in bidding strategies

Pros

- Strong revenue lifts; publishers report 30-130%+ initial increases

- Impressive demand stack

- Google Certified Publishing Partner with responsive account management

Cons

- Heavier ad implementation increases the risk of CLS and can affect Core Web Vitals.

- 5-month minimum contract reduces the flexibility of testing platforms

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

AdPushup

AdPushup is an ad revenue optimization platform that enables publishers to maximize their ad revenue with automated testing and advanced monetization features. Founded in 2014 and a Google Certified Publishing Partner, this platform combines AI-powered ad layout optimization with comprehensive demand access. A distinctive feature of AdPushup is its pro-user adblock recovery solution, where ads get reinserted as per Acceptable Ads standards and can also be hidden by the visitors if needed. This platform is just perfect for established publishers rather than those at an early stage in their monetization journey.

Model: Revenue Share (CPM-based)

Minimum Traffic Requirement: None

Features

- AI-powered automated A/B testing of ad layouts and placements

- Header bidding with access to 50+ premium ad exchanges

- Pro-user adblock recovery solution with Acceptable Ads compliance

- Visual ad manager with 15-minute JavaScript integration

Pros

- Fast integration

- Powerful automated testing

- Full-service platform supporting header bidding, ad mediation, AMP ads, and ad block recovery

Cons

- The performance might fluctuate according to the niche

- Revenue share model of 20-40% which may affect net earnings compared to self-managed solutions

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Media.net

Media.net is the leading contextual ad network powered by the Yahoo! Bing Network, providing publishers with exclusive access to search advertisers and premium demand from tier-1 geographies. Specializing in contextual ads targeted at keywords and user intent to match ads to page content, it ensures highly relevant ad placements that naturally blend into the site design. As one of the world’s largest contextual ad networks, reaching over 100 million US desktop users monthly, Media.net provides strong monetization, particularly for content-rich sites with US, UK, and Canadian traffic. The network is fit for publishers seeking competitive rates without managing complex optimizations themselves.

Model: CPM

Minimum Traffic Requirement: None

Features

- Access to Yahoo!, Bing and programmatic demand

- Native ad formats that blend seamlessly with site content and design

- Effective targeting through Contextual Ad Technology

- Ad units that are customizable with multiple size options

Pros

- Unmatched search demand

- Smooth approval process as compared to Google AdSense

- Dedicated account manager provides hands-on optimization support

- Can run simultaneously with AdSense to diversify revenue streams

Cons

- Performance heavily dependent on tier-1 geographic traffic

- Weak performance on generic content

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Sovrn

Sovrn is a technology platform offering dual monetization opportunities for publishers of all sizes with no minimum traffic requirement. The platform provides CPM-based display advertising through header bidding and Sovrn Commerce, which automatically converts existing product links into affiliate links. Sovrn works better as a secondary SSP to complement other monetization solutions rather than serving as a full-stack primary solution.

Model: CPM (display ads); CPC/CPA (Sovrn Commerce affiliate links only)

Minimum Traffic Requirement: None

Features

- Header bidding and waterfall advertising with server-to-server bidding support

- Automatic affiliate link insertion through Sovrn Commerce for passive monetization

- Complete control on ad placements through Ad Management software

- Real-time reporting on ad performance, revenue, and key metrics via the Meridian platform

Pros

- No minimum traffic requirement

- Multiple avenues of earning revenue- programmatic ads and affiliate monetization

- Low $25 minimum payout threshold ideal for smaller publishers

Cons

- Lower eCPM rates for non-US traffic

- NET 90 payment schedule is longer than most competitors

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Index Exchange

Index Exchange allows publishers to monetize display, video, CTV, mobile and native ad inventory from a single source.

Additionally, due to being a trusted partner for many industry-leading DSPs and advertising agencies, Index Exchange helps publishers access a large spectrum of global premium demand.

One potential drawback to consider is that the interface is not as user-friendly as other networks on the list. When starting with the platform, publishers are more likely to face a steep learning curve.

Model: CPM

Minimum Traffic Requirement: None

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

TripleLift

TripleLift is a premium programmatic ad network partnering with major advertisers, including Nestlé, P&G, Microsoft, and Toyota. The platform supports multiple ad formats, including display, video, CTV, branded content, and native advertising. TripleLift’s native ads use dynamic templating to match both the look and feel of the publisher’s site while remaining contextually relevant to content. Publishers retain 70-80% of ad revenue through a revenue share model, with payment options ranging from NET 30 to NET 90. The platform works best for publishers seeking strong native and video formats to complement their primary monetization strategy rather than serving as a standalone revenue solution.

Model: CPM

Minimum Traffic Requirement: None

Features

- Dynamic creative optimization that customizes native ads in real-time to match publisher site design

- Multiple ad formats

- Complementary design services for ad placement customization

- CTV ads appear organically

Pros

- Native ads match site aesthetics and drive revenue growth

- Access to premium advertisers and major brands exclusively

- Low $50 minimum payout threshold

Cons

- Delayed onboarding due to individual publisher review

- Not a primary revenue source

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Vuukle

Vuukle is a publisher workspace platform combining audience engagement tools with programmatic ad monetization. The platform works with 400+ publishers globally, serving 6 billion ad impressions across 300 million monthly users. Vuukle partners with several demand-side platforms and demand partners to optimize ad monetization. The platform is distinguished by its AI-powered comment moderation system and unified workspace that combines engagement, analytics, and monetization tools. Vuukle is best suited for publishers building comment-driven communities who want integrated engagement and monetization features, though general RPM growth may be weaker compared to specialized ad optimization platforms.

Model: CPM

Minimum Traffic Requirement: None

Features

- AI-powered comment moderation with live analytics

- Unified publisher workspace combining engagement, ad revenue tracking, and analytics

- Programmatic ad monetization with access to 25+ premium DSPs

- Interactive engagement widgets, including reactions, quizzes, and social sharing tools

Pros

- Infrastructure auto-scales for any traffic volume

- Unified workspace combining engagement and monetization data

- Transparent reporting system with hourly updates

- Strong community engagement

Cons

- General RPM growth may be weaker

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

AdMaven

AdMaven is a performance-driven ad network that focuses on pop-under, push notification, and interstitial formats. It monetizes millions of publisher websites around the world and serves more than 4 billion impressions every day. Publishers are allowed to choose from a few different options for payment, including PayPal, Bitcoin, Wire Transfers, and Payoneer. Most methods have no minimum payout threshold, with Bitcoin minimum payout lowered to $1, while wire transfers still require a $1,000 minimum payout. Pop-under and interstitial advertising are very aggressive, so it is not recommended or suitable for brand-safe or premium content sites.

Model: CPM, CPC, CPA, CPI, CPL

Minimum Traffic Requirement: 2,500 daily visitors

Features

- Several high-performing ad formats, including pop-unders, push notifications, banners, sliders, and interstitials

- Advanced geo-targeting and device targeting with real-time bidding technology

- Native Push Notifications are compatible with Google AdSense policies

- Global reach with ad inventory available in over 200 countries

Pros

- Low traffic requirement of 2,500 visitors per day, with automatic approval

- Anti-ad block opens more revenue options

Cons

- Not suitable for brand-safe or premium content sites because of aggressive interstitial advertising

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Adsterra

Adsterra is a performance-driven ad network that specializes in pop-under, push notification, and social bar formats. Adsterra’s Social Bar ad format is fully customizable, letting creatives take any form-from chat widgets to video teasers and messenger icons. The network’s very own Anti-Adblock solution can increase publisher revenue by as much as 35%. Due to the intrusive nature of pop-under and push ads, Adsterra has higher malware and spam risks and thus is not suitable for brand-safe or reputable publishers who value user experience highly.

Model: CPM, CPC, CPA, CPI, CPL

Minimum Traffic Requirement: None

Features

- Proprietary Anti-Adblock technology that increases revenue up to 35%

- Self-serve platform with over 20 options for targeting: geo, device, OS, browser, language, carrier, and frequency capping

- 100% fill rate with access to over 20,000 campaigns running simultaneously

- Strong API access

Pros

- No minimum traffic requirements for getting started

- Very low minimum payout ($5 for Paxum/WebMoney)

- Enhanced CPM rates through real-time bidding

- 24/7 support via live chat with dedicated account managers

Cons

- Pop-under and interstitial formats are intrusive and may harm user experience

- Payments are made biweekly (NET 15), which can be slower than some competitors

0.5

1

1.5

2

2.5

3

3.5

4

4.5

5

Final Thoughts

Working with ad networks is one of publishers’ core monetization strategies. However, a reliable ad network must be carefully selected to avoid placement requests for irrelevant ads.

The best ad networks listed above are all trusted and have solid working relationships with advertisers and publishers. Yes, some do have high requirements in terms of traffic and content quality. But if the publisher’s goal is to build a sustainable online business, then these requirements shouldn’t represent a significant obstacle.

Monetization is only one aspect of business sustainability, however, and publishers should also be on the lookout to improve their operational efficiencies wherever possible. Given that for most publishers operational efficiencies can likely be squeezed out of the software they use, consider exploring our list of best digital publishing platforms in 2024

FAQs

Which Ad Network Pays the Most?

Payout rates and revenue share vary based on the network, the advertiser’s bid price and the publisher’s content and traffic.

It’s essential that publishers research and compare multiple ad networks and their payout models to find the one that best suits their needs and goals.

Do Any Ad Networks Pay Better Than AdSense?

Multiple ad networks pay better than AdSense. That said, it’s a good idea to experiment with other ad networks and ad formats to find the combination that works best.

What Are the 3 Different Types of Ad Networks?

The three most popular ad network systems are:

- Vertical ad networks

- Horizontal ad networks

- Premium ad networks

What Is a Vertical Ad Network?

A vertical ad network focuses on a specific niche or industry. They may have a limited number of publishers and advertisers, but they offer highly targeted advertising options.