Publishing is experiencing a dual economy where two halves appear to be headed in different directions. On one hand, publishers with email and user lists are experiencing record growth and revenue. On the other hand, the largest cohort of publishers is experiencing unprecedented challenges and regressing visit numbers that match falling revenue. The outlook for both may not change for a while.

A Tale of Two Digital Publishing Economies

Publishers that have spent the last decade accruing and building audiences—in the form of emails and phone numbers—to fuel popular mediums like newsletters and SMS threads have seen a thriving digital economy that shows no signs of slowing growth. The success of these publishers demonstrates a renaissance of sorts, bolstered by external factors contributing to unprecedented growth.

In contrast, traditional digital publishers that have historically relied on search engines and other platforms to reach their audience are facing significant challenges. This environment has created a perfect storm of obstacles and compounding factors that have led to a proportional slowing or decline in growth.

Not surprisingly, Ezoic data shows rising revenue and rates among publishers with growing audiences, and the inverse for those with declining visits. This principle—that revenue correlates with audience growth and popularity among web users—remains unchanged and holds true for individual sites over time as much as it does for large cohorts and groups on average. Recently, the impact on revenue we’ve observed with ad rates seems more pronounced than usual for both types of publishers.

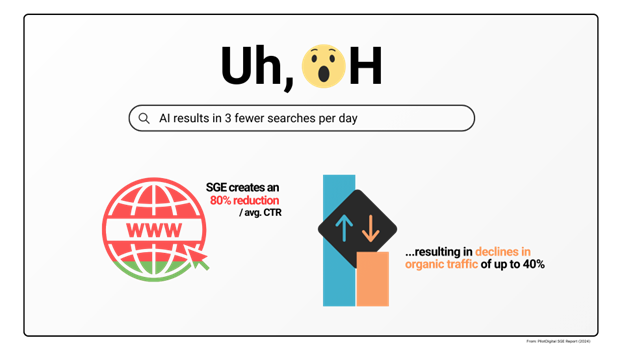

Sites With Direct Audiences Are Better Prepared For The Future

The integration of AI-powered technologies into search engines, such as Google’s Search Generative Experience (SGE), has drastically disrupted traditional publisher revenue streams and traffic models. With projected losses of $2 billion annually in digital ad revenue and traffic declines of 20% to 60% due to AI-generated summaries providing direct answers, publishers reliant on organic search face increasing challenges ( NY Post). This shift has not only reduced user engagement with original content but has also jeopardized affiliate models and visibility on search engine result pages (SERPs).

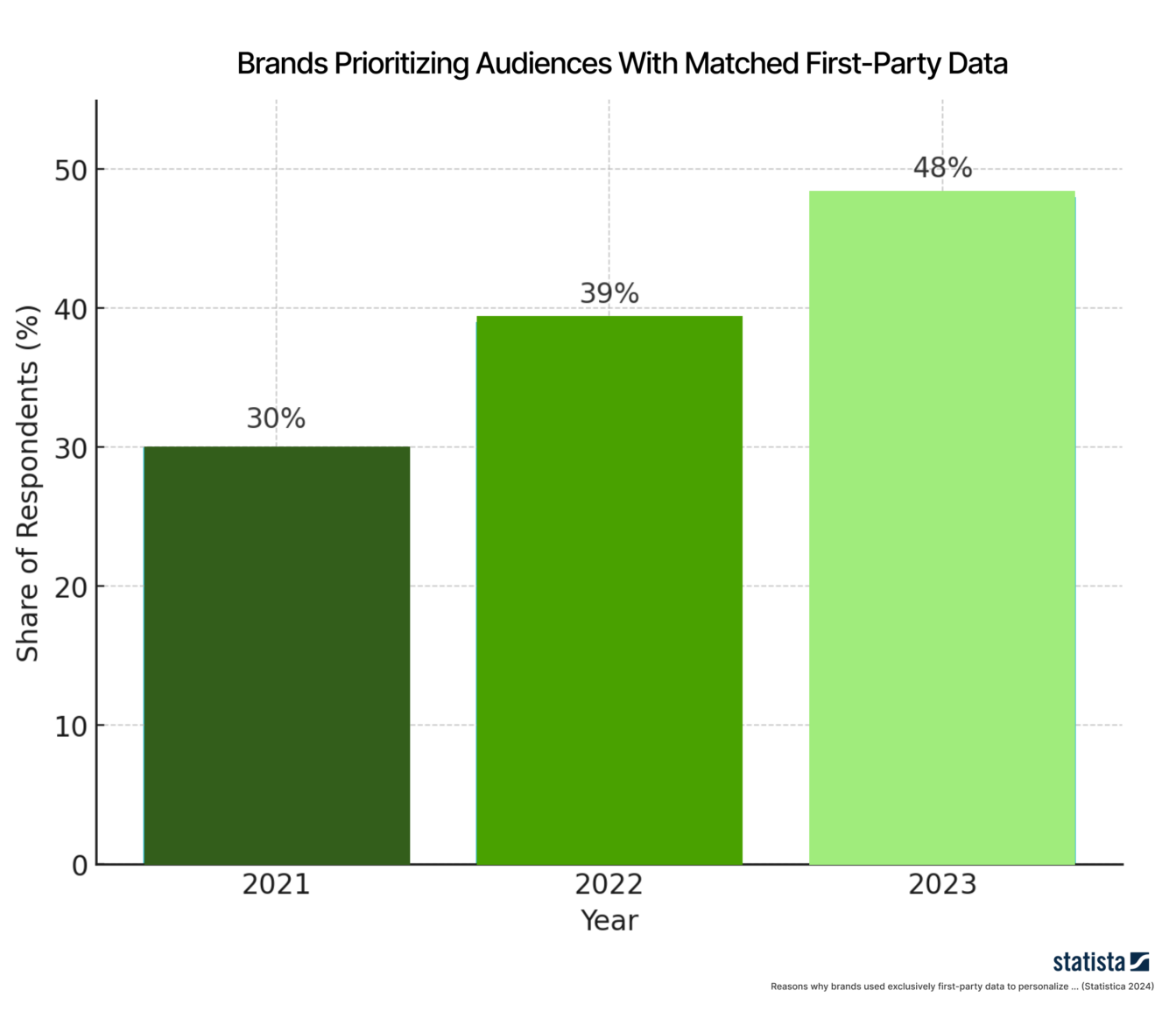

Meanwhile publishers with direct audience relationships are largely excluded from these risks and have — at minimum — a major head start over publishers that previously may have focused on search engines that see ‘owning an audience’ as the only reliable way to mitigate these risks long-term. They also are seeing record revenues from advances in identity protocols designed to help advertisers buy audiences directly from publishers and audience aggregators. Ezoic is seeing unprecedented demand from advertisers seeking to bid on these types of audiences; both directly and through partners that work in tandem with them, like Audiengent, who essentially bundle high-quality audiences from first-party data at scale for advertisers.

Diversification of traffic sources has always been considered a best practice but is easier said than done for most websites; who typically have limited resources and must strategically emphasize specific channels to grow and find success. But it’s not just publishers that see the writing on the wall with ‘organic’ (unpaid) search traffic. Advertisers are pouring record amounts of cash into owned platforms like email newsletters and mobile apps. Email marketing stands out as a particularly effective solution, offering an average ROI of $42 for every $1 spent, with personalized campaigns delivering open rates above 20% and click-through rates around 3% (Statistica). Advertisers and publishers alike recognize the value and reliability of emails as both a gold standard connection to an audience and verification for who the audience actually is; making targeting of content and ads more effective.

There is some hope among SEO-reliant publishers that LLM platforms, like OpenAI, will serve as more of a replacement or partial replacement for whatever market share they take away from search engines. Collaborations and licensing agreements with AI platforms, such as those established by Axel Springer and the Associated Press, are emerging as a proactive approach to manage content usage and secure fair compensation. Although, a dark cloud already overhangs the optimism of wooing LLM platforms; as publishers are pursuing legal actions to protect intellectual property from unauthorized AI scraping, as seen with the New York Times’ legal initiatives against OpenAI and Microsoft. This underscores skepticism of these platforms being benevolent actors and highlights the risk of gambling on their efforts to include publishers in their plans.

Explained: Compounding Benefits of Audience Relationships

Without understanding how the advertising industry has responded over the last 3-4 years, publishers might wonder why now is first-party data such a disruptive force that has caused such a large economic rift between types of publishers.

Ezoic has watched rainmakers, like The Trade Desk, develop and pioneer innovations that have built value for individual publishers’ audiences with things like their Universal ID; which is a key component that facilitates the buying and selling of first-party data. Partnerships between companies like The Trade Desk, Audigent, and Ezoic are just a few of parties that have come together to allow publishers to effectively cut out Google; whose dominance with publishers had allowed them to sell audiences to advertisers using 3rd-party cookies — effectively making individual publisher audiences indistinguishable

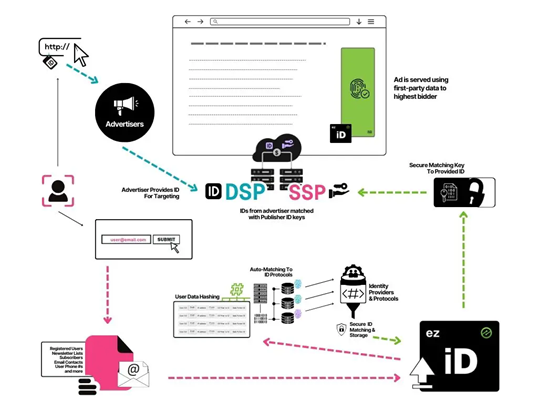

These chains of aforementioned partners now operate on recent open identity solution protocols and providers that have come about the last few years as companies like Apple have depreciated or outright blocked the use of 3rd-party cookies. These identity protocols matured to the point of great effectiveness for advertisers. In fact, the demand is incredibly strong for publishers that are set up to collect and integrate with these selling protocols. Unfortunately, the number of publishers currently implementing their own first-party data has not caught up to the demand yet on the advertising side. Mostly, it’s the largest list publishers and major brands at the moment. But solutions like ezID are providing a platform that makes the complex setup and integration of these types of partners mentioned above and connecting them to these protocols a lot more familiar and seamless for publishers than it would be without an end-to-end tool.

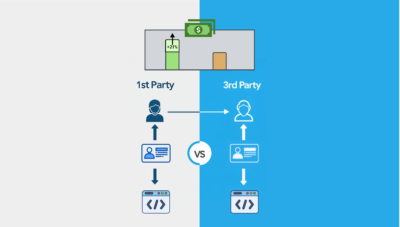

The Juice Is Worth The Squeeze When Publishers Gain Greater Self-Reliance

First-party data and identity solutions give sites an advantage they didn’t have before. Their first-party data can now help them stem their reliance on Google and other gatekeepers for both traffic and revenue. For publishers, first-party data can be effectively thought of as emails or phone numbers of visitors or readers collected by the publisher. Identity solutions, or ‘first-party data solutions,’ are a broad term referring to a non-specific collection of the protocols, providers, technologies, and/or partners that make-up the buying environment that allows the transaction between publishers and advertisers for this data.

Ezoic example of the chain in which first-party data is securely used for targeting

How this process works:

- Publishers keep their list and no actual data is shared. Emails are hashed and serialized (anonymized so that an ID can be matched for targeting only, and the publisher’s info never leaves their possession).

- Data is serialized and matched with identity solution protocols. There are dozens that are relevant and multiple hashing protocols, which is why adoption has been slow among publishers until ezID made it much easier for sites to implement efficiently and effectively without the resources of a major media brand.

- Information is stored securely where advertisers and identity protocols can match them on request using unique user IDs (UIDs).

- UIDs are synchronized with user login details or matched with ad IDs from advertisers when users land on a page.

- Personalized, high-quality ads are served in a privacy-focused manner to the reader.

This allows advertisers to target their audience more precisely with retargeting, without third-party cookies or intermediaries like Google, and instead conceptually work directly with the sites or publishers that have relationships with these audiences.

These Trends Are Accelerating, Not Slowing

Publishers leveraging first-party data strategies are experiencing substantial gains across visitor segments, with RPM (revenue per thousand impressions) increases varying by operating system. These results underscore the value of first-party data in enhancing engagement and revenue.

Publishers who continue to navigate algorithm changes and AI disruptions may not get much reprieve in the near-term; as just about every measure of adoption of LLMs on the web is projected to rise in 2025. Publishers cultivating email lists, exploring multi-channel distribution, and building their own audience relationships have a brighter outlook with less uncertainty around sustainable revenue and long-term audience engagement amidst these evolving marketplace dynamics.