Programmatic advertising has come to dominate the advertising landscape over the last decade, with publishers and advertisers seeking to buy and sell ad inventory more efficiently.

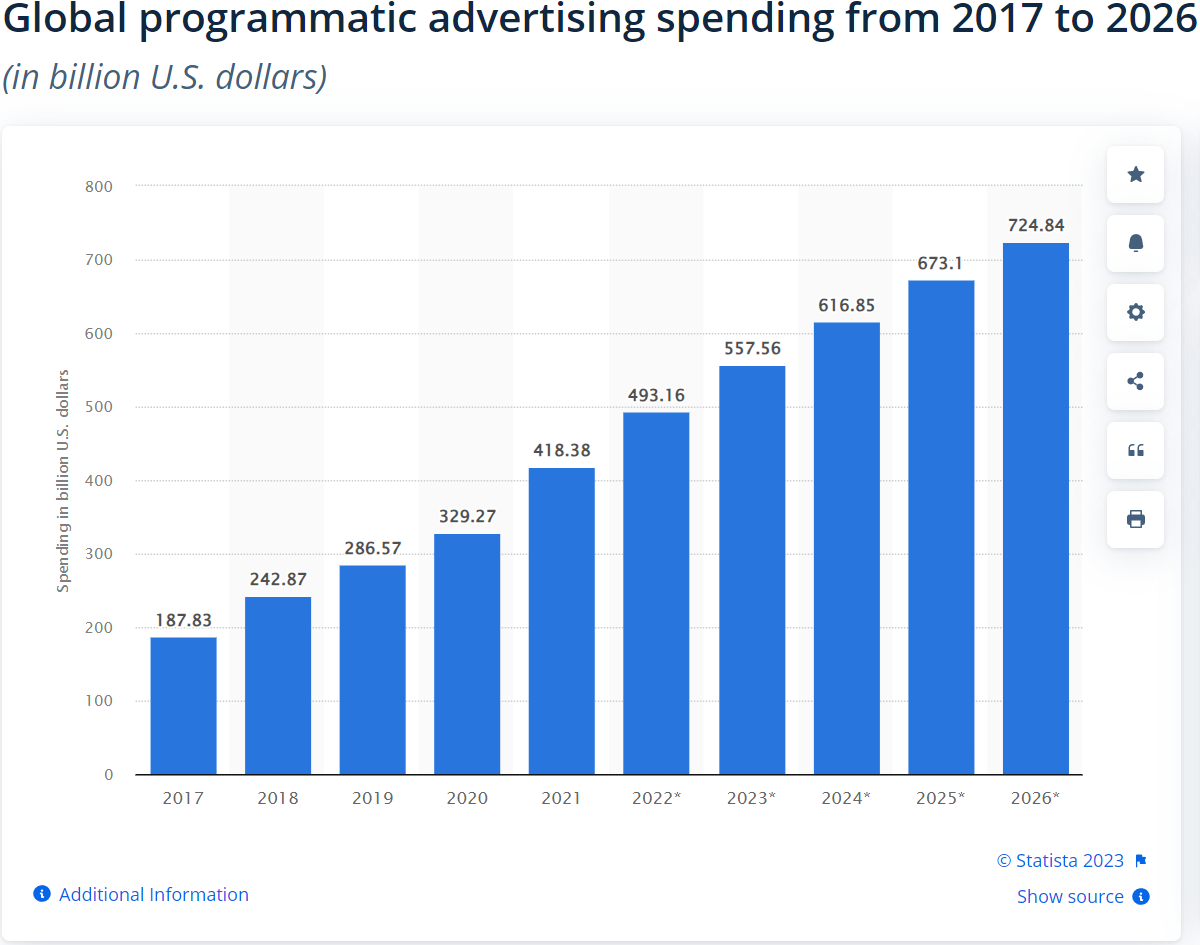

The technology has gained traction because it has streamlined the ad sales process by tapping into AI and machine learning. Global programmatic ad spend is forecast to climb from nearly $188 billion in 2017 to almost $725 billion in 2026. This anticipated growth is mainly because of technological advancements that could further disrupt the digital advertising space.

Source: Statista

The automation of ad sales has been a win-win for both sides. Publishers have boosted ad revenue by improving audience targeting, showing more relevant ads and increasing ad deal efficiency.

Join us as we explore programmatic advertising, how it works and its benefits for publishers. In addition, we’ll shed light on programmatic ad trends of 2023 and briefly discuss medium-term forecasts.

What Is Programmatic Advertising?

Programmatic advertising is the automated buying and selling of ad inventory in real time via online ad-tech platforms. Unlike the long, cumbersome method of manually selling ad units, it makes the entire sales and ad placement process fast and simple. Make this possible is each programmatic ad-tech platform’s use of algorithmic software.

Publishers who are still new to online marketing often use the terms programmatic ads and display ads interchangeably. Both use technology and data to buy and sell ad space, but there are fundamental differences.

Let’s quickly cover the differences to better understand what programmatic advertising is and isn’t before diving deeper.

Programmatic Ads Vs Display Ads

Programmatic advertising covers a much broader spectrum of advertising formats and surfaces, including display advertising. Programmatic is not limited to display ads, however, and allows advertisers to buy ad space on a wide range of digital platforms, such as display, social media, mobile apps, digital out-of-home (DOOH), radio and connected TV (CTV) ads.

Publishers can sell display ads to advertisers through direct negotiations, but programmatic platforms also provide this ability through what’s known as a programmatic direct or guaranteed deal. These deals involve publishers selling ad units to a buyer at a negotiated fixed price.

Programmatic advertising also makes it easy for advertisers to reach a specific target audience through real-time data and algorithms. And, because of its AI-powered algorithms, publishers can display relevant ads to their target audience, boosting engagement rates.

Now that we’ve covered programmatic advertising’s basics, let’s explore how programmatic advertising actually works.

How Does Programmatic Advertising Work?

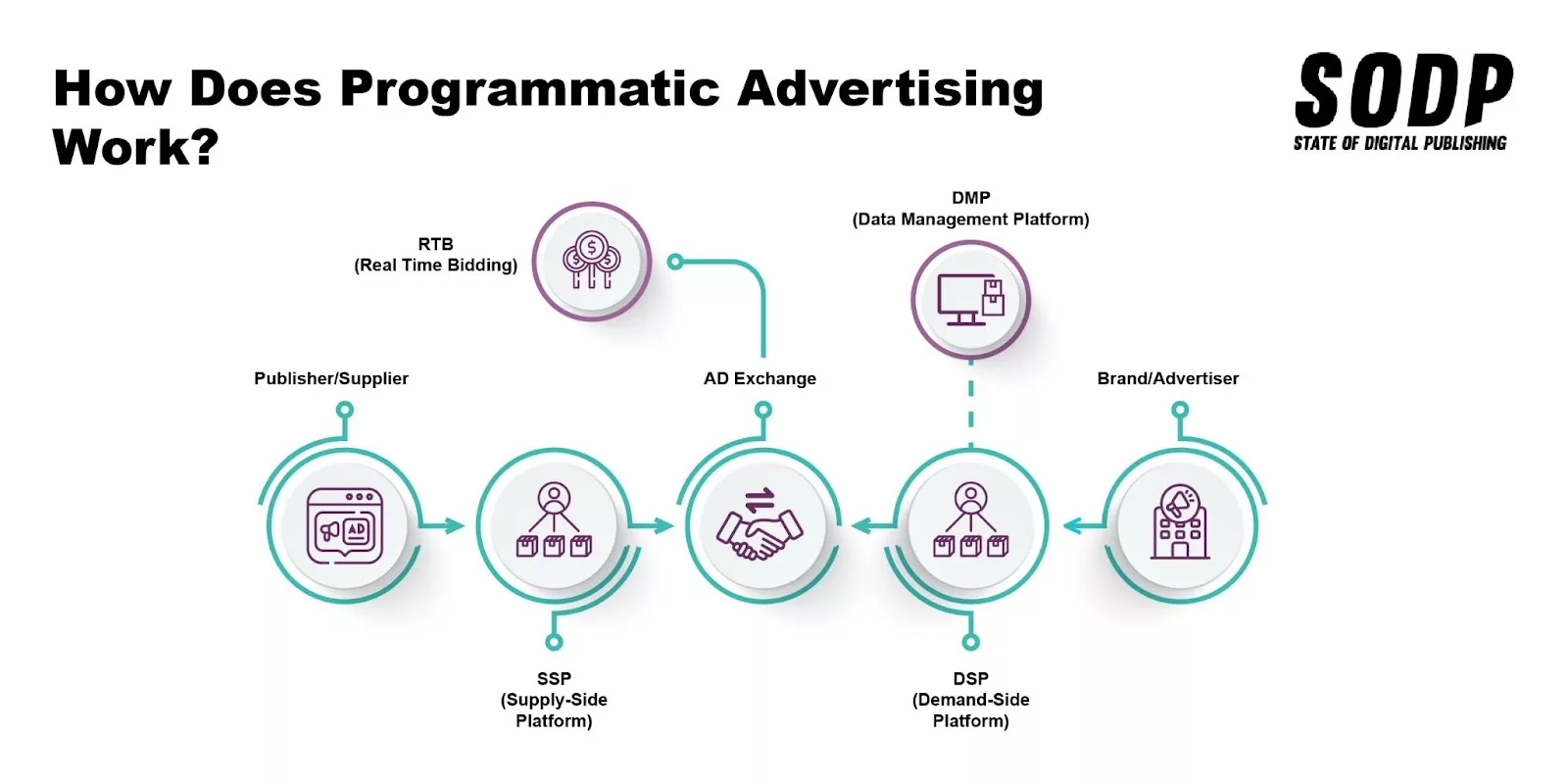

Publishers and advertisers sit at either end of the programmatic process, using different ad platforms to automate ad deals.

As mentioned above, the four key components of programmatic advertising are demand-side platforms (DSPs), supply-side platforms (SSPs), ad exchanges and data management platforms (DMPs).

It’s a good idea to learn a little about each platform before we dive into the roles they play in selling ad space.

- SSPs: Publishers use these platforms to maximize their ad revenue by offering available ad inventory to multiple demand partners. With SSPs, publishers can set pricing, categories and brand safety guidelines and then request ads from many buyers.

- DSPs: Advertisers and agencies use DSPs to buy ad spaces from publishers via multiple ad exchanges and SSPs while controlling ad spend. DSPs allow advertisers to buy ads across all digital platforms, from web and mobile to digital-out-of-home (DOOH) and connected TV (CTV). Advertisers can also manage every aspect of their ad campaigns, from programmatic advertising cost and audience targeting to performance tracking and campaign optimization.

- Ad exchanges: Ad exchanges serve as an open marketplace, where publishers and advertisers can close ad deals. The most popular ad deal is the automated real-time bidding (RTB) auction, which allows buyers to bid for ad impressions. These auctions display ad spaces to many advertisers, which improves a publisher’s ad fill rate and maximizes ad revenue potential. The highest bidder wins the right to display the ad on a publisher’s platform.

- DMPs: These platforms are data warehouses that collect and organize information before sharing it with SSPs, DSPs and ad exchanges. DMPs are key to building audience profiles, which helps in content customization and improves targeting. A data management platform (DMP) captures data, such as visitor browsing behaviors, from a publisher’s website via tracking pixels.

As seen from the platform breakdown above, advertisers and publishers use programmatic advertising with different goals in mind. Publishers want to increase ad revenue, while advertisers want to reach audiences while minimizing their budget.

A publisher’s first step is to select the right SSP, which will share available ad inventory with DSPs, ad networks and ad exchanges. After that, they’ll set a price at which they want to sell their impressions. Once that happens, website tracking pixels collect, organize and send details about the publisher’s website, audience behavior and available inventory to demand partners.

When a web page loads, its ad spaces become available for bidding. SSPs send a request for ads to multiple demand partners, with ad exchanges allowing interested advertisers to bid on ad impressions in an RTB auction.

How a Programmatic Auction Works in 5 Simple Steps

- A visitor opens a web page.

- The publisher’s SSP sends a request for bids to demand partners.

- Ad exchanges hold an RTB auction.

- Advertisers bid on ad impressions through their DSPs.

- The highest bidder’s ad is displayed to the visitor.

There are other programmatic deals available, however, both through an ad exchange as well as with direct demand partners.

Programmatic Advertising Deal Types

As mentioned above, more deals than just real-time bidding (RTB) are available in programmatic marketing. A variety of auction options are available as well as direct deals. These include private auctions, preferred deals and guaranteed deals.

Let’s break down the four deal types:

- RTB: This is when a publisher opens their inventory to all advertisers and the bidding takes place in real-time, which is why it’s also known as an open auction. When publishers make available their ad inventory at a specific cost on ad exchanges through the supply-side platform, every interested advertiser can bid on it. The highest bidder wins this open auction for ad impressions.

- Private auction: Private auction, also known as a closed auction, is an invitation-only auction. Publishers invite a select group of advertisers, DSPs and ad networks to participate. Much like an open auction, publishers can set a minimum CPM, and the highest bidder wins the ad space.

- Preferred deal: The preferred deal involves publishers agreeing to prioritize a particular advertiser’s bid over others in an auction. Advertisers secure that priority by agreeing to a fixed bid. That doesn’t mean the advertiser must bid in the auction, but if they do, their bid will be prioritized.

- Guaranteed deal: Also known as programmatic direct, guaranteed deals enable publishers’ direct sale of ad space to advertisers. During direct negotiation between the two, publishers agree to offer a fixed set of ad impressions to advertisers, who have to pay a negotiated price to get their ads placed on a publisher’s web page or other platforms.

How Much Does Programmatic Advertising Earn?

This is a challenging question to answer, given that the cost of programmatic ads will vary from platform to platform. Other factors to consider are content niche, ad format and the advertisers buying the ad space.

Advertisers buy ad inventory based on the cost per thousand impressions (CPM). This is the average price that publishers want their ad spaces to sell for. According to Google, programmatic ad CPMs can average between $1 and $5, with direct ad sales being as much as two to four times higher.

Publishers ultimately control the CPM in programmatic advertising, being able to set price floors for their ad space. This prevents advertisers from buying ad impressions at a price lower than the set price, guaranteeing a minimum ad revenue for publishers.

Also, programmatic advertising’s first-price auction model allows several advertisers to bid for the same ad space, maximizing publishers’ revenue potential.

It’s worth remembering, however, that advertisers can set campaign budgets on their DSPs, which will scour SSPs and ad exchanges looking for the best price for their clients. An advertiser may tell its demand side platform (DSP) to prioritize websites with content relevant to its brand. Some may prefer to pay a lower rate to increase their reach, even if the content and ads don’t perfectly align.

Benefits of Programmatic Advertising

Programmatic advertising has almost taken over the digital marketing space by storm, owing to its many benefits for advertisers and publishers.

Here are some of those benefits:

Automation of Buying-Selling Process

Programmatic advertising has automated the buying and selling of available ad space, eliminating the need for direct negotiations, paperwork and manual processes, which are tedious and time-consuming. The automated processes save time and resources, which allows publishers to focus on their core competencies.

And programmatic advertising has provided publishers the quickest way to receive ads for their websites or other platforms.

Positive and Relevant Experiences

Visitors will not engage with an ad if it isn’t relevant to them. Viewing ads unrelated to the surrounding content can be a jarring experience, damaging publisher reputations.

With programmatic advertising, publishers can use data-driven targeting and ad placement to provide a positive user experience (UX). Programmatic advertising’s algorithms ensure ads are relevant to visitor interests and preferences.

Price Setting Power

In programmatic advertising, publishers can set the price, or CPM, at which they want advertisers to buy ad inventory. And only the highest bidder wins the right to place their ad on a publisher’s web page or other digital channels.

Also, programmatic advertising offers the publisher access to a large number of advertisers. The competition for ad space increases the bid price, further boosting ad revenue.

Better Ad Fill Rates

Ad fill rates refer to the number of ad impressions that show against the number of ad requests sent to ad exchanges. With programmatic advertising, publishers can optimize ad fill rates, ensuring maximum ad spaces are filled with ads. This helps to minimize remnant ad inventory and maximize ad revenue.

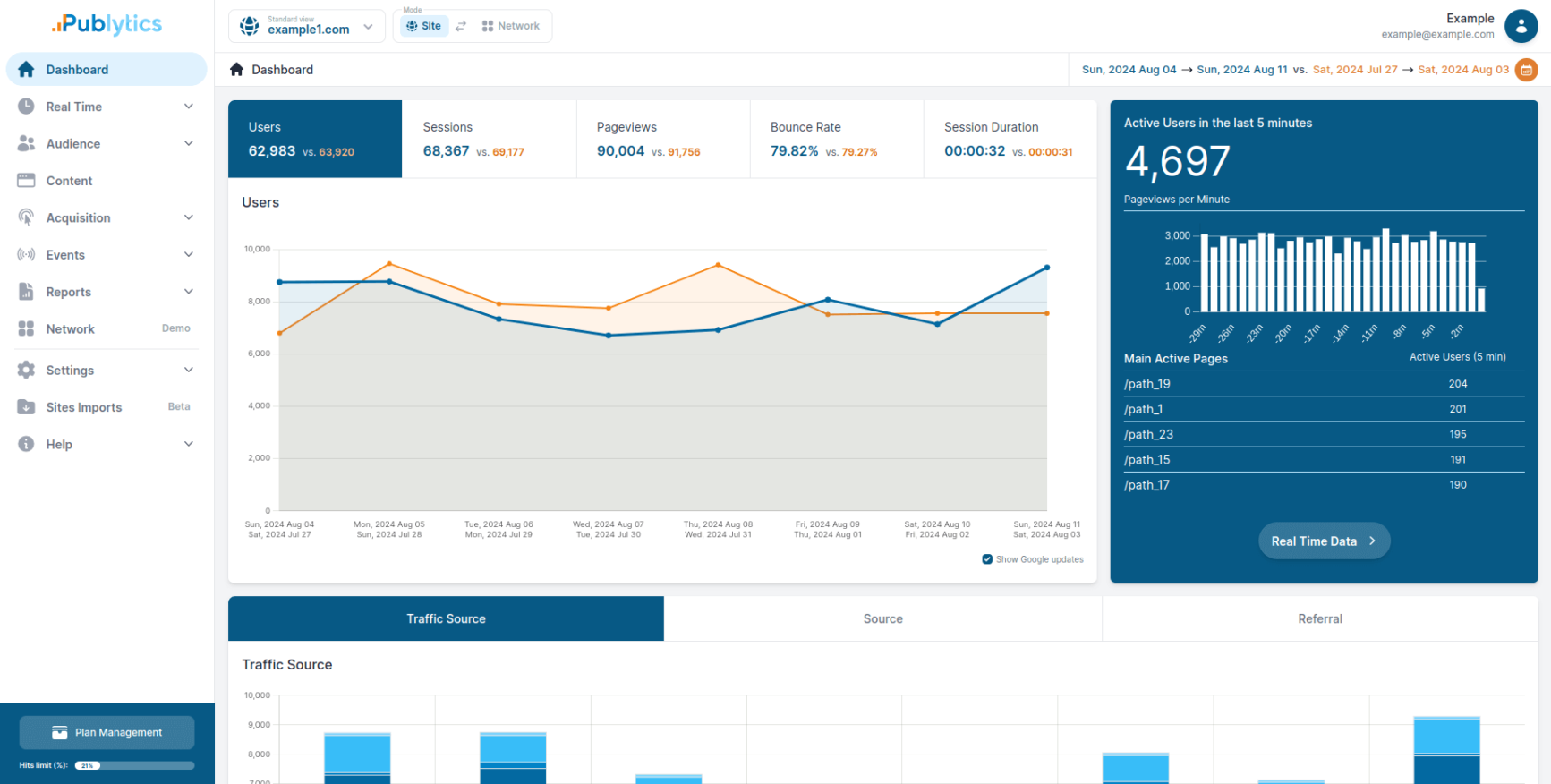

Insights Into Ad Inventory Performance

When publishers use performative advertising, they unlock access to real-time data and valuable insights into the performance of their ad inventory. They can analyze ad impressions, click-through rates (CTRs), and revenue generated, allowing them to make informed decisions and optimize their marketing strategies for better outcomes.

Different Ad Formats

Publishers also benefit from programmatic advertising support for different ad formats, including native ads, display ads, video ads, mobile ads, and digital-out-of-home (DOOH) ads. Because of that, ads placed on different channels don’t hinder the UX.

Programmatic Advertising Trends

The online advertising landscape is continuously evolving, mainly because of technological advancements and ever-changing consumer behavior. These factors also impact programmatic advertising, resulting in new trends every year.

Here are five programmatic advertising trends to watch out for in 2023 and beyond.

Greater Focus on Transparency

The lack of transparency in programmatic advertising has been a serious concern for publishers and advertisers. Publishers often don’t have complete visibility over an advertiser’s identity. That makes it difficult for them to check whether an ad that will appear on a web page is appropriate and relevant.

Sometimes publishers also don’t have full transparency into the bidding process and an advertiser’s actual bid price. As a result, it’s difficult for them to confirm whether or not they’re fully compensated. The Interactive Advertising Bureau (IAB) has also noted that there is a lack of transparency over fees and net CPMs and recommends a more transparent bid environment.

Transparency is critical for developing trust in the programmatic advertising ecosystem, and in 2023, advertisers and publishers are demanding greater transparency in the buying and selling of ad impressions. They also demand more openness from ad exchanges, DSPs, SSPs, and other platforms. The programmatic advertising space is also seeing an increased adherence to industry standards on transparency.

Taking Full Control of Programmatic Campaigns In-House

When programmatic marketing first became popular, many advertisers and publishers were unfamiliar with it and didn’t know how to use it. They, therefore, outsourced the responsibility of managing programmatic campaigns to third-party agencies and ad networks. Now, in 2023, they are taking back that control. The trend to handle programmatic campaigns in-house has caught on.

Both publishers and advertisers see several benefits in running ad campaigns in-house. For example, in-house campaign management gives publishers more say in selling their ad inventory. They also have more control over the types of programmatic ads displayed on their websites and have greater visibility in the bidding process and performance of ads.

And, as advertisers and publishers can access data analytics, they can determine what is working for them and take steps to improve. Data also provides publishers with the information needed to optimize their ad inventory and enjoy increased ad revenue.

By reducing their dependency on third-party agencies, publishers and advertisers also save on their fees.

Rise of Private Marketplaces (PMPs)

Both publishers and advertisers want a programmatic advertising experience that is safe, transparent, and effective so that their reputations do not take a hit. The open ad exchanges promise that but often fail to deliver on that 100%.

This has led to a growing preference for PMPs. These are invite-only marketplaces where publishers make their premium ad inventory available to a select few advertisers. Such marketplaces allow publishers to sell their ad spaces directly to advertisers on their terms.

This approach gives publishers greater control over ads, ensuring they align with their brand value and are relevant to their visitors/customers. This ensures a positive visitor experience, resulting in a higher engagement rate.

Rise of White-Label Platforms

White-label platforms are ready-made platforms that companies can buy, rebrand as they need and use them as their own. Offered by third-party providers, the white-label platform eliminates the need for companies to develop their programmatic advertising software from scratch, which is a highly costly, time-consuming endeavor.

White-label DSPs simplify the process of media buying for advertisers. It also ensures that they receive all the necessary data in real time and don’t pay more than needed to buy ad inventory. And a white-label SSP enables publishers to manage their ad inventory quickly and efficiently. It also makes it easy for them to decide on ad format/s, who they are targeting and the right bid price.

Content from our partners

White-label SSPs also solve the issue of publishers receiving less than the actual price paid by advertisers, as it offers greater transparency in the buying and selling process. And another advantage of white-label platforms is that they are scalable solutions.

Rise of Digital-Out-of-Home (DOOH) Programmatic Advertising

Programmatic DOOH automates buying and selling of ad spots on digital billboards and other signages, allowing companies to reach their target audiences when they’re on the go.

DOOH programmatic advertising has been gaining traction over the last few years. For example, US DOOH ad spend in 2023 is projected to account for 36% of total OOH media ad spend in 2023, with the figure expected to rise to 41% in 2026.

DOOH programmatic advertising is proving to be very effective, combining the benefits of programmatic advertising — such as automation, real-time bidding (RTB), and data management platforms (DMPs) — with OOH’s impact and wider reach.

It also offers advertisers and publishers the benefit of agility and flexibility; for example, they can start and stop running ads quickly.

And, as with previous years, the trend in 2023 continues to be toward using AI-powered algorithms and machine learning to improve programmatic advertising efficiencies and effectiveness.

Programmatic Advertising Forecasts

There’s a consensus within the broader advertising industry that programmatic ad buying is only going to expand its hold over the digital marketing space in the coming years. For example, programmatic ads are expected to account for 86% of digital ad revenue by 2026.

Other estimates suggest that the programmatic advertising market could grow by $314.27 between 2021 and 2026 — a 26.66% CAGR. The open auction segment is expected to drive growth, with North America set to continue leading the global market.

The increasing number of mobile marketing platforms and rapid global digitization are also factors that should fuel this growth.

Rising smart device use, meanwhile, may help global programmatic display advertising reach $2.77 trillion by 2028 — a 31.9% CAGR.

The market for DSPs and SSPs is also expected to witness significant growth. During the 2023-2030 forecast period, the DSP market is set to grow at a 4.4% CAGR. The global SSP market was worth $23.95 billion in 2023 and is expected to grow at a 13.36% CAGR.

With brands increasingly spending much of their marketing budget on digital channels, the demand for SSPs is expected to boom in the coming years. Rapid growth within digital advertising will likely drive publishers to seek advanced ad management tools.

Final Thoughts

From the above stats, it’s clear that the future for publisher ad revenues lies with programmatic advertising. That’s not to say that direct ad sales are not valuable, simply that programmatic’s scale is unparalleled.

Publishers that haven’t embraced the programmatic buying and selling of ads should consider their options now so they can begin maximizing their online ad revenue potential as soon as possible. This starts with understanding what programmatic advertising is and how the buying and selling process works. The next step is for publishers to choose an SSP that best suits their needs and objectives.

Programmatic advertising holds many benefits for publishers, the most obvious being the ability to offer inventory to multiple demand partners, driving up bids and maximizing revenue.