Ads are an integral aspect of online life. Appearing as banners, video spots and social media feeds/stories, digital ads are everywhere. Ad exchanges play a vital role in the distribution of these ads, and yet, very few people can answer the question: What is an ad exchange?

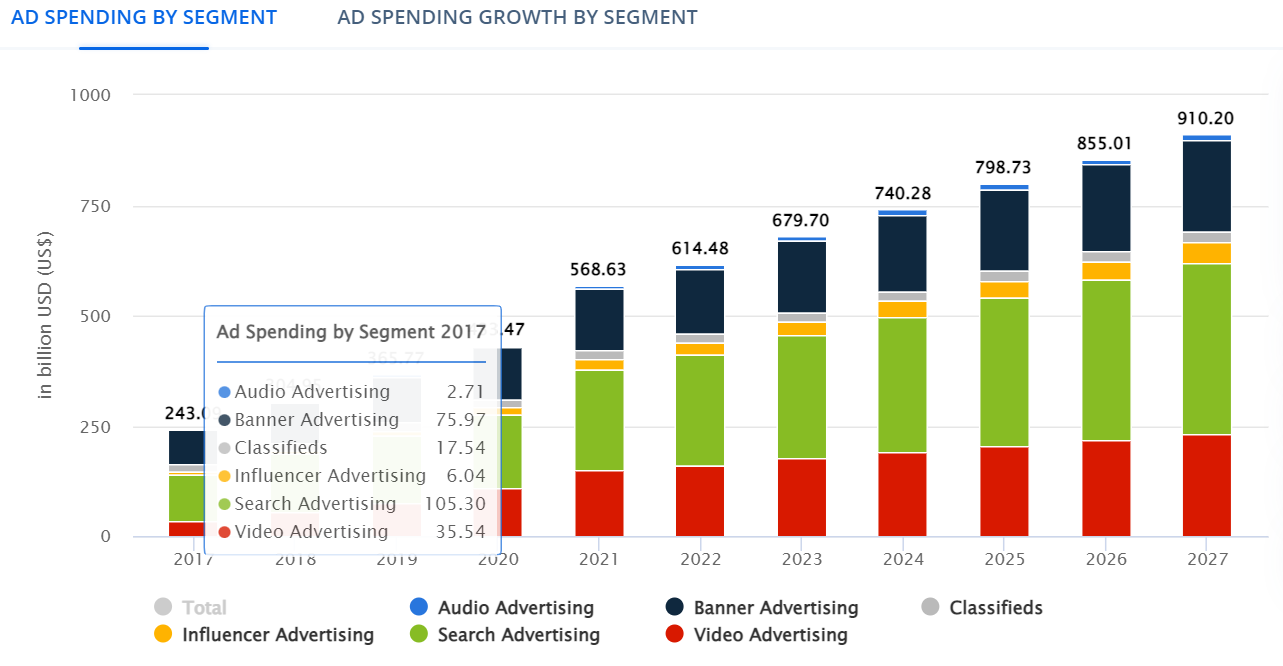

That is a $600 billion question in 2023, and its value will keep increasing with each passing year. The global eCommerce industry is growing at a rapid clip, with sales expected to climb to $9.4 trillion by 2026 from $6.5 trillion in 2023. And the amount of money companies spend on digital ads is projected to hit almost $680 billion in 2023, a rise of 10.5% year on year.

Source: Statista

At the same time, the global economy continues to teeter on the brink of a recession. Slashed marketing budgets are the norm as at least 30% of advertisers face increasing pressure to boost ROI with less.

As the stakes keep rising, a working knowledge of ad exchange platforms is essential for any professional or entrepreneur whose business involves online marketing in some form. This article will take a deep dive into the world of ad exchanges and explore how they work, their advantages and the role they fill in the digital advertising landscape.

What Is an Ad Exchange?

An ad exchange is an online marketplace where advertisers buy digital ad inventory from publishers, often through real-time bidding (RTB) auctions. An ad space could be inventory on a website or mobile app, or a few seconds of air time during a podcast or video stream.

The sellers who own such spaces are collectively called publishers. A publisher could be a:

- Website owner

- App developer

- Social media platform

- Video streaming service

Those that want to buy these ad spaces are called advertisers. This group includes:

- Product manufacturers

- Service providers

- Third-party ad agencies

- Intermediary ad networks

- Performance marketers

Advertisers use these spaces to post various types of digital ads and reach specific target audiences.

Buying and selling of ad inventory on the exchange generally takes place through a bidding process, but direct deals can also take place. Bidding happens in real-time and is automated through advanced software and algorithms. The entire process is driven by the basic rules of supply and demand:

- The publishers want to sell their ad space at the highest price

- The advertisers want to buy the best ad space at the lowest price

The ad exchange is the platform where the two parties can meet and fulfill these needs. The first-ever ad exchange was created by Right Media, which pioneered the concepts of programmatic advertising in the early 2000s.

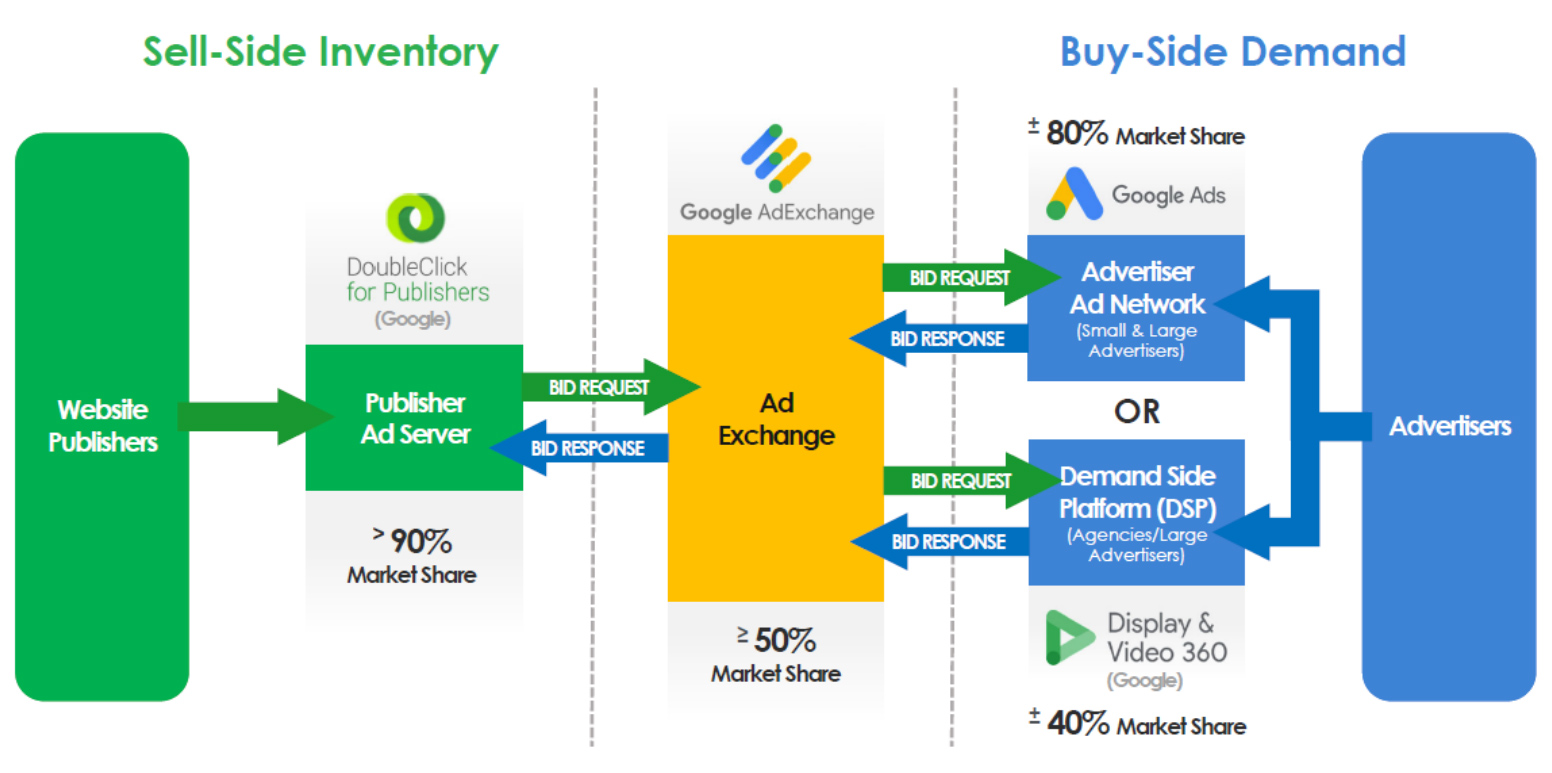

Although Right Media pioneered the model, it was Google that successfully harnessed it, dominating the ad landscape over the last two decades. Google AdX is the largest ad exchange in the industry and, while it’s unclear exactly how much market share the platform commands, the US Department of Justice estimates it to be 50% or greater in 2023.

Source: US DoJ

Other major players in the ad exchange space include OpenX, Rubicon Project, Index Exchange, AppNexus and Verizon Media.

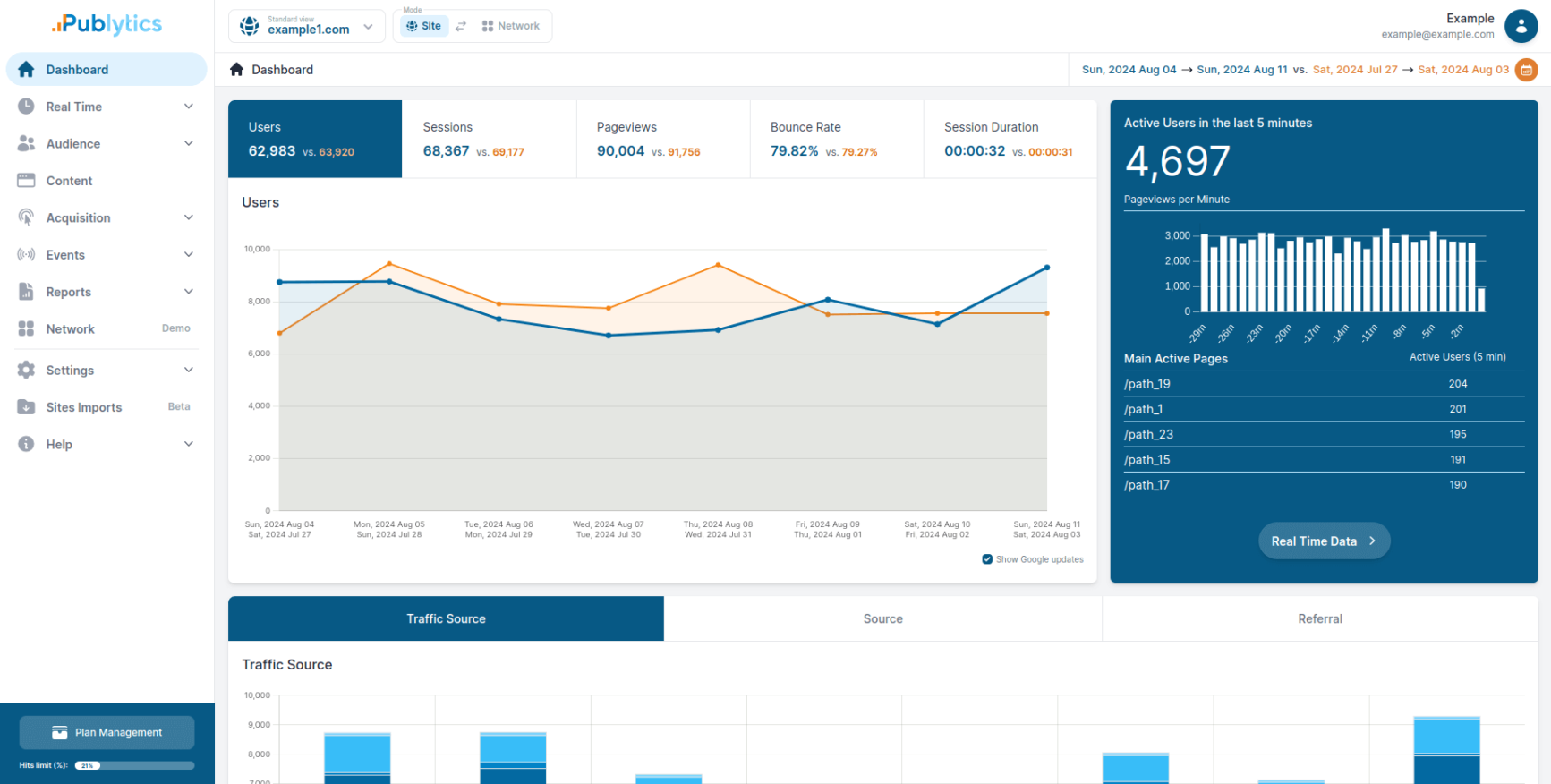

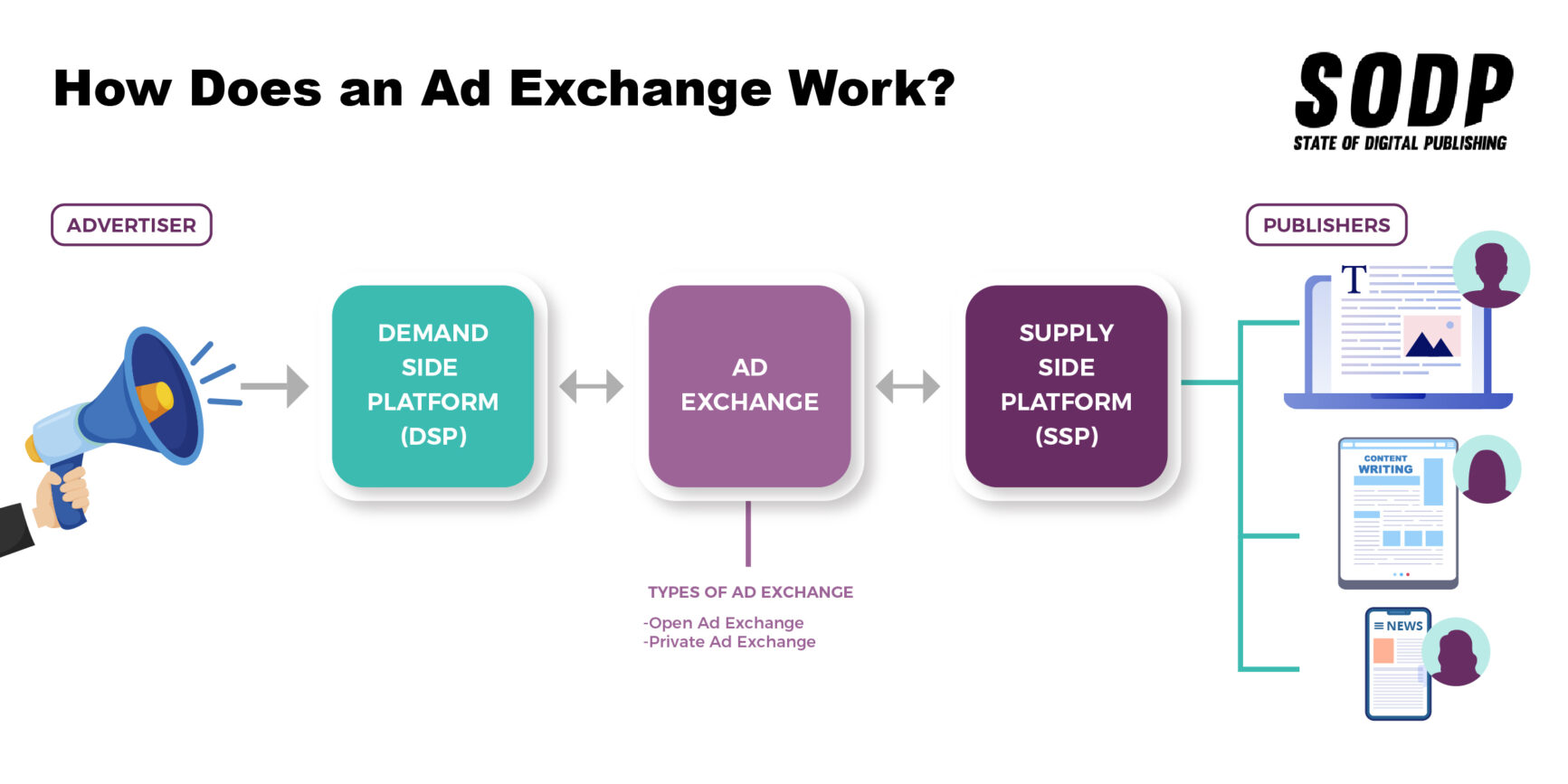

How Does an Ad Exchange Work?

In the simplest terms, ad exchanges serve as digital marketplaces where ad sales are conducted.

To better understand how an ad exchange works, however, it’s essential to explore the programmatic advertising space. Programmatic advertising involves the automated buying and selling of ad inventory using a combination of advanced technologies and data. Ad exchanges are a central component in the wider ecosystem of programmatic advertising.

Programmatic advertising was created because the traditional methods of bulk buying ad spaces in advance simply don’t work efficiently online. Instead, a system of automated buying and selling was developed, using advanced algorithms, machine learning and artificial intelligence (AI) to analyze vast troves of data.

A core concept in programmatic advertising is RTB — the breakthrough technology that revolutionized everything about modern digital marketing. Instead of buying ad space in advance, advertisers can bid for spaces in real-time.

Here is how the process works:

1. Bid Request

Things start when a user visits a website, opens a mobile app or clicks on a video on a platform such as YouTube. At that point, a bid request is sent from the publisher to a supply-side platform (SSP). The request will contain various details about the user, including their location, browser history and other demographic data.

2. Supply-Side Platform (SSP)

An SSP is a software platform that allows publishers to automate the process of selling their available ad inventory to advertisers. These platforms are usually connected to multiple ad exchanges and multiple ad networks. When an SSP receives a bid request from the publisher, it forwards them to an ad exchange and kick-starts the bidding process.

3. Demand Side Platform (DSP)

If the SSP is a seller-side platform, the DSP is its equivalent on the buyer’s side. It helps advertisers and advertising agencies automate the process of bidding for ad spaces that fit certain criteria. The advertiser will specify their target audience, ad formats, the type of ad inventory they want to bid on, and their budget preferences (a process called targeting). They also upload relevant ads into the DSP.

4. Automated Bidding

The bid request from the publisher is forwarded by the SSP to the ad exchange. DSPs connected to the ad exchange view the bid request and submit bids on behalf of interested advertisers if the bid matches the preset criteria.

Usually, the bidding involves multiple advertisers and the one with the highest bid wins the auction. The DSP sends the ad from the winning bidder to the ad inventory. The entire process is completed within a few milliseconds.

Types of Ad Exchanges

Over the years, ad exchanges have steadily evolved into several different forms with unique features and capabilities. As things stand, three broad categories of ad exchanges exist online in the digital marketing space.

1. Open Ad Exchange

As the name suggests, an open ad exchange is a digital marketplace that is open to all buyers and sellers. Anybody can participate in these exchanges as there are no restrictions on publishers based on any minimum selection criteria in ad networks.

The bidding on open exchanges takes place in real-time and multiple advertisers can compete in buying and selling ad inventory. Buyers have access to a wider selection of ad inventory, with prices also trending lower side as a result.

However, open marketplaces also come with some serious drawbacks. Advertisers don’t have access to detailed background information on the publishers, increasing reputational risk. For many brands, a publisher’s quality and relevance are of vital importance. If an ad appears next to content that doesn’t reflect the brand’s values then it can affect brand image.

Other drawbacks of open ad exchanges include:

- Increased risk of fraud through bots, fake clicks and misleading traffic

- Pricing fluctuations

- Lower quality ad inventories

2. Private Ad Exchanges

In stark contrast to an open exchange, a private ad exchange functions as a closed platform where the publishers hold sway. Access to these platforms is reserved for a selected group of premium publishers and advertisers.

Also known as private marketplaces (PMPs), these platforms forsake quantity and focus more on quality. The selected advertisers on these exchanges have exclusive access to high-quality ad inventories.

The ad spots on these exchanges often cater to specific demographics and audience segments. Although they lack the volume and low pricing of open ad exchanges, PMPs offer significant advantages, including:

- Fraud prevention

- Transparency

- Improved audience targeting

- Better brand safety

Preferred Deal

This type of ad transaction usually takes place on a PMP and involves a publisher and advertiser directly negotiating an ad sale

The advertiser will often receive priority access to certain segments of a publisher’s ad inventory.

In exchange for already negotiated prices, the advertiser will have the chance to buy that inventory before anyone else gets a chance to bid. The publisher can sell the spots through auction to other buyers if the preferred advertiser passes.

This type of arrangement is a win-win situation for both parties. The deal usually involves exclusive or highly desirable ad inventory. The buyers get a chance to lock down a good ad spot in advance, while the publishers enjoy stable relationships with premium brands.

Benefits of Ad Exchanges for Publishers and Advertisers

Ad exchanges are popular in programmatic advertising because they offer a slew of benefits to both publishers and advertisers. Here’s a detailed look at some of the more prominent advantages for both sides:

Advantages for Publishers

1. Increased Ad Revenue

Publishers gain access to a wide range of advertisers on an ad exchange. And, thanks to the competitive bidding process, they have a chance to maximize their available inventory’s potential ad revenue. This is especially true in the case of private ad exchanges.

2. Improved Efficiency

Thanks to the high levels of automation, publishers can monetize available inventory faster and more consistently with each new visitor over time. The risk of unused inventory is much lower with ad exchanges.

3. Control Over Pricing

On both open and private exchanges, publishers can specify the minimum floor prices for their available ad inventory. This way, discerning publishers who own premium ad spots can reduce the risk of being underpaid for that space.

Advantage for Advertisers

1. Cost Savings

Manual negotiations with publishers are often time-consuming and highly inefficient in terms of operating costs. Ad exchange automation empowers brands to access preferred ad spots at highly competitive prices. The entire process is highly optimized and streamlined, leading to significant cost savings.

2. Improved Ad Targeting

The best ad exchanges often provide value-added services that include sophisticated audience tracking and targeting capabilities. These tools allow advertisers to deliver their ads to specific audiences with great accuracy, leading to improved conversion rates and better RoI.

3. Real-Time Flexibility

Campaign parameters can be tweaked in real-time using the DSPs and the RTB tools on ad exchanges. Using these tools advertisers scale their campaigns based on factors like budget and sudden changes in market conditions.

4. Data Analytics

Ad exchanges provide a wide array of sophisticated data analytics tools to advertisers. Leveraging these tools and targeted metrics, brands can gain access to critical insights regarding the performance of specific campaigns — such as the number of ad impressions a campaign has secured — which helps identify new ways to optimize existing strategies and ad formats.

Difference Between Ad Exchanges and Ad Networks

An ad exchange is a digital marketplace that connects buyers and publishers through real-time bidding, while an ad network purchases inventory from publishers and sells it to advertisers. There are two separate transactions in ad networks, while an ad exchange acts as a facilitator of a single transaction.

An ad network also offers dedicated support whereas ad exchanges are technological enablers. There is also a considerable difference in how an inventory is priced in ad networks and ad exchanges.

Final Thoughts

Programmatic advertising is estimated to have cornered more than 90% of all digital ad spend in 2022. At the same time, the DoJ has launched a lawsuit against Google, the dominant player in the digital ads market, for monopolistic business practices.

Content from our partners

While an adverse verdict would be a major blow to Google’s main source of income, it could also have a positive impact on the wider ad exchange marketplace. Google AdX and AdSense are far from the only worthwhile players in the industry, with plenty of top-rated ad networks out there for publishers and advertisers alike.

With the rise of more sophisticated AI, such as GPT4, the industry is on course for further disruption. A silver lining from the rise of large language models (LLMs) could include the deployment of faster, more efficient algorithms for targeting and automation. Even the pushback from tech giants and governments in recent years against user tracking is a welcome step in the right direction.

Ads need to be better at balancing user privacy while delivering improved RoI to advertisers and publishers. The recent changes in the regulatory and tech space will only incentivize ad exchanges, ad networks and advertisers to improve existing systems. The next few years could bring big changes to this dynamic industry, with both ad networks and exchanges potentially benefiting immensely.

FAQs

Who Runs Ad Exchanges?

Tech companies tend to dominate this market owing to their expertise in building the software platforms, infrastructure and advanced algorithms required to operate a modern ad exchange. The biggest ad exchanges are run by tech companies, with Google, Rubicon Project and OpenX are the best examples of this arrangement.

What Is the Largest Ad Exchange?

The largest ad exchange in terms of market share and potential reach is Google AdX. In the digital advertising optimization market, the company has a vice-like grip with more than 50% market share. The US DofJ confirms this in a recent lawsuit (PDF download) against the monopolistic practices of the tech giant.

What Is an Example of an Ad Exchange?

OpenX is an example of a leading ad exchange used by more than 100,000 advertisers around the world. It has a wide network of 130,000 publisher domains and apps, handling over 200 billion ad requests per day.

The company has a unique architecture that is 100% cloud-based. The OpenX ad exchange connects publishers and advertisers through an RTB process. It is an open, independent marketplace where publishers can sell their available inventory in various ad formats.

Who Buys from Ad Exchanges?

Many entities approach ad exchanges to purchase ad space from online publishers, with the most common being brands seeking to promote their products and/or services.

Instead of buying ad space directly, many companies rely on third-party advertising agencies to handle their digital campaigns. After collaborating with their clients to create an ad campaign, the agencies buy suitable ad inventory for the campaigns via ad exchanges.

Companies and ad agencies also rely on specialized software such as demand-side platforms (DSPs) to optimize and automate their purchases on ad exchanges.

Larger organizations or ad agencies with deeper pockets can afford in-house teams to handle the complex processes associated with programmatic ad buying. Smaller organizations and companies rely on third-party intermediaries, which may be agencies or software, to handle the purchases.

How Do Ad Exchanges Make Money?

As marketplaces that act as an intermediary connecting buyers and sellers, ad exchanges charge a percentage of the transaction value as fees from buyers and sellers.

Ad exchanges contain several forms of data and associated services that are extremely valuable for digital advertisers. Segmented audience data and advanced targeting capabilities allow companies and agencies to optimize their ad campaigns. Access to these services usually comes with additional data usage fees.

Further, exchanges can also charge additional fees for advanced features and specific functionalities such as reporting, different targeting options, consultations and other value-added services.