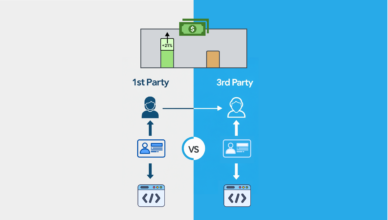

The death of 3rd party cookies has been imminent for some time; the industry just wasn’t sure when D day would arrive. With Google announcing that they are phasing out of 3rd party cookies, the timeline has been set. Now, it is up to everyone to source new solutions to recover lost revenue and audience tracking capabilities.

There is an air of uncertainty as numerous solutions begin to be implemented and tested to eventually assist publishers to recover revenue and stabilize from what for some has been a silver bullet. Within all of the speculation, one recurrent belief appears to be the need for generating first-party audience data to fill the void that 3rd party cookies have left.

First party data allows publishers to strengthen the relationship with their audience well beyond what any 3rd party platform could ever do. With an engaged and loyal following, publishers are able to analyze and leverage the data they garner into a truly exclusive audience; an audience that nobody knows better than they do. This is incredibly valuable, as it assists publishers in recovering the direct placement dollars that were lost years ago to the rise of programmatic syndication.

Publishers appear to be choosing a myriad of options towards generating first-party data. Some publishers are building internal capabilities, like Insider, who is strategically choosing to overhaul their audience data platform, Saga, with the intention of taking a consultative approach. While others continue to look towards emerging technologies to find a quick and effective leg up on the competition.

Ziff Davis appears to be ahead of the pack in utilizing Market Research and Survey as means to generate first-party data, as well as monetize their audience. This comes as no surprise knowing that the digital survey market is expected to reach a market size of $6.9 billion USD by the year 2022. Ziff Davis has partnered with Lucid (luc.id), the leading marketplace in programmatic survey, as well as a relatively unknown engagement and rewards solution called Madai (monetize.madai.com). The need to comply with both privacy requirements (GDPR and CCPA) and anonymity in terms of market research and Insights best practices is critical in the link between publisher’s traffic and survey respondents. Throw in an incentive as well and now you can see why Madai was selected to partner them both.

The combination of first-party data generation, in conjunction with the Market research boom we are witnessing, appears to have created the perfect environment for publishers to own their audience and begin to play in the world of survey. Each publisher has a different audience that can be leveraged for different survey Niches. For instance, PC Mag has tech savvy IT decision makers, while Bloomberg has high level B2B profiles, both are sought after survey audiences that command high prices.

As the Publisher landscape matures, it is certain we will see a diversification of revenue verticals, hedging long-term futures away from risky all-in strategies that load a silver bullet into the chamber and leave it to wait for new regulation, higher walled gardens, and shifts in the attention economy. It is exceedingly evident that Market research should become an arrow in each and every publisher’s quiver as they move forward to a self-controlled destiny.