While warning signs of a global recession have been mounting for months, a new report has sent a clear signal to publishers that they need to prepare for leaner times.

UK advertising industry body IPA’s quarterly report into the marketing sector, which was released on July 21, showed an increasing sense of pessimism among professionals amid a quarter-on-quarter slowdown in second-quarter ad budget increases.

The IPA Bellwether Report – 2022 Q2, a poll of around 300 UK marketing professionals, showed that of the surveyed companies, 24.2% raised their total marketing expenditure, while 13.4% had registered budget cuts. This resulted in a net growth of 10.8%, down from a net growth of 14.1% in the opening quarter.

Budget Breakdown

Breaking down its survey results, the IPA noted that there had been no growth in the main media category — which includes big-ticket advertising campaigns relating to TV. The segment’s stagnation ended a year-long period of growth and stood in sharp contrast to the net positive of 9.4% that was recorded in January-March.

The industry body added that growth in “other online” budgets slowed to 4.4% from 18.6%, while net budget increases in video advertising amounted to just 0.8%, down from 9%.

The share of companies cutting budgets in the audio segment accelerated, with a net negative of 16.4% recorded, up from the negative 8.5% seen in the first quarter. It was a similar story in the out of home (OOH) segment, which saw a net negative of 15.9%, compared with the negative 4.6% posted in the January-March period.

The number of companies willing to commit ad spend with published brands slipped to negative 2.6%, reversing the first quarter’s net positive of 1.3%.

The IPA said companies were tightening their belts in the face of growing recessionary fears and uncertainty over the rising cost of living.

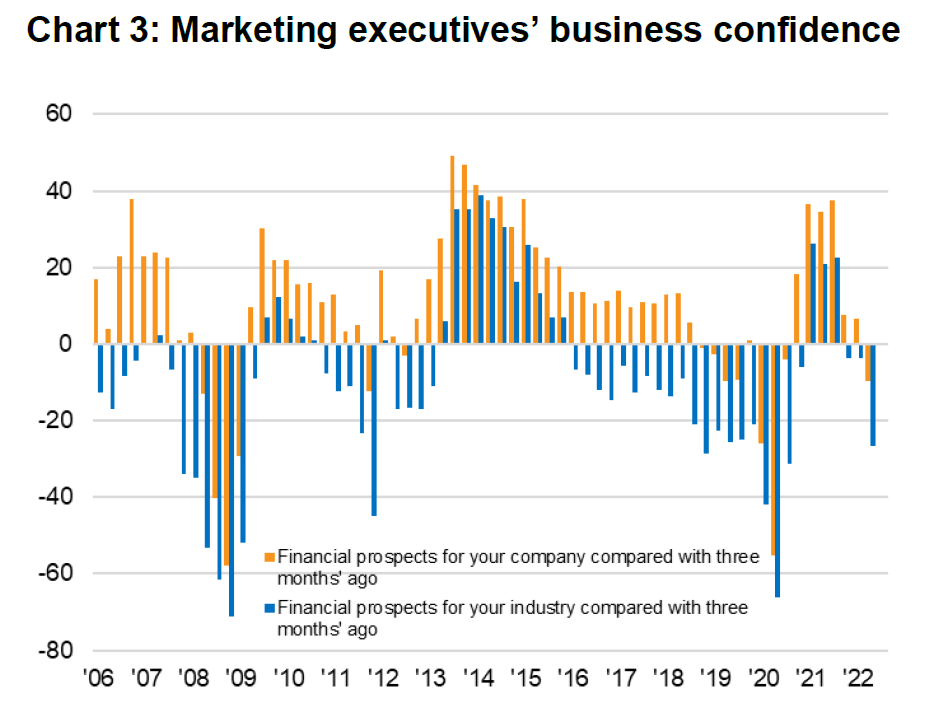

IPA director general Paul Bainsfair said: “The second-quarter report shows that marketers are understandably concerned about the challenging business climate ahead, as reflected in the deterioration of their financial prospects.”

However, he applauded those companies willing to “market aggressively” amid the “mounting economic headwinds”, arguing that history showed the wisdom of such strategies.

He said: “Cutting ad budgets — relative to competitors’ spend — in a recession undermines companies’ ability to grow future market share and profits.”

Pessimistic Outlook

Bainsfair’s comments came in response to the report’s finding that a net balance of 26.7% of companies surveyed had lost confidence in the wider industry’s financial prospects. This was an acceleration from the first-quarter negative of 3.6%.

Indeed, the IPA warned that these economic headwinds had driven it to slash its own 2022 ad spend forecast to 1.6% from 3.5% previously. It added that these challenges could spill over into 2023 and beyond, prompting it to trim its ad spend growth forecast for next year to 0.8% from 1.8%.

Weigh Your Options Carefully

Alkimi Exchange CEO and co-founder Ben Putley told State of Digital Publishing (SODP) that publishers needed to prepare for tougher competition for ad dollars.

He said: “Though ad budgets are still increasing, marketers are going to be watching closely where they spend. For publishers, this is going to mean increased competition for spend, and possibly a drop in revenue. Not only will they need to look more attractive to potential advertisers, but they will also need to maximize the potential of any income.”

He argued, however, that publishers’ first resort shouldn’t necessarily be to make cuts and that they should instead examine their ad supply path.

Putley said: “In traditional ad exchanges, almost half of committed ad spend is kicked up to the operators of the exchanges — this is a huge amount of potential income publishers are missing out on.”

The executive said publishers should look for alternatives and argued in favor of decentralized ad exchanges. He added: “By recording all transactions on a distributed ledger, deals can be more transparent with spend better accounted for and precisely how much value was driven as well as dramatically reduced trading fees.’’